The following is a guest post by Vincent Malifard, Marketing Director at IntoTheBlock.

When you first hear about Bitcoin staking, you might think that it is a mistake, given Bitcoin’s proof-of-work (PoW) mechanism. However, Bitcoin staking is real, with thousands of addresses participating and generating returns on their assets. Here’s what you need to know.

Bitcoin Staking Explained

Staking traditionally refers to the process by which cryptocurrency holders lock up funds to participate in network operations, such as validating transactions, on a Proof-of-Stake (PoS) blockchain. However, Bitcoin operates on a PoW consensus mechanism that does not natively support staking. This dynamic has changed with the introduction of Bitcoin staking through platforms that offer Bitcoin-based Liquid Staking Tokens (LST). These platforms allow BTC holders to indirectly participate in staking activities.

EigenLayer, Babylon, and AVS

Ethereum introduced the concept of ‘restaking’ in 2023. Own layerBy mid-2024, it had gained significant momentum and reached TVL (Total Value Locked). More than $20 billion in June. Staking ETH typically helps secure the Ethereum network and rewards the staker. EigenLayer extends this concept by allowing users to “restake” their ETH to secure additional services and earn additional rewards.

Originally named Active Validated Services (AVS) on Eigenlayer, the terminology varies depending on the (re)staking platform involved. AVS is an application or service that can be secured with re-staking ETH. The concept is now being extended to the Bitcoin blockchain and BTC-pegged tokens. Babylon Leading this effort is the architecture that allows applications to leverage the crypto-economic security of Bitcoin. Meanwhile, on the Ethereum side, Symbiotic and soon Eigenlayer are re-staking protocols that accept tokens like Wrapped Bitcoin (WBTC) as collateral to support applications that want to leverage these assets for enhanced security.

Understanding Bitcoin Staking

In Bitcoin staking, users deposit BTC into a staking protocol and receive Liquid Staking Tokens (LST) in return. These LSTs represent staked BTC, but often offer enhanced liquidity and other features. This allows participants to participate in DeFi activities without sacrificing staking rewards.

The most popular Bitcoin LST currently is LBTC. Lombard Protocol. Here are the details on how it works:

- How LBTC is created: To mint LBTC, a user sends BTC to a special address linked to the Babylon protocol. This action creates LBTC on Ethereum, which acts as a placeholder for the Bitcoin sent.

- What will happen to BTC?: The BTC actually transferred is safely stored within the Babylon protocol contract. Currently, these BTC are not used or accessible, but are still safely stored.

- Compensation for depositors: While BTC is kept as a reserve, depositors are rewarded with points from the Babylon and Lombard systems as an incentive for participation.

- Future plans: The goal is to eventually secure the broader ecosystem using the BTC held in Babylon’s contracts. This includes various apps and chains using this BTC to secure their networks while maintaining a connection to the main Bitcoin network.

The leading protocol for Bitcoin staking

In the Bitcoin staking space, several protocols have emerged as leaders.

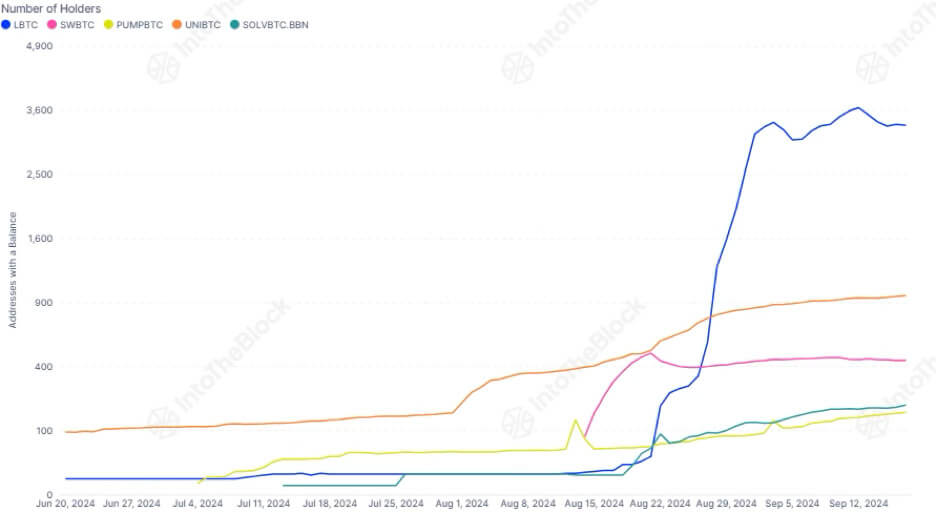

- Lombard Staked BTC (LBTC): As a leader in this market, LBTC has seen a significant increase in its market capitalization. It currently has over 3,000 holders and is valued at $300 million.

- UniBTC: UnitBTC initially gained a significant number of holders. LBTC has overtaken it, but still ranks second with around 1,000 holders.

- Swell BTC (SWBTC): SWBTC had a strong start and looked set to overtake uniBTC. However, growth has slowed and it now sits in third place with around 440 holders.

Is Bitcoin Staking the Future of Bitcoin Returns?

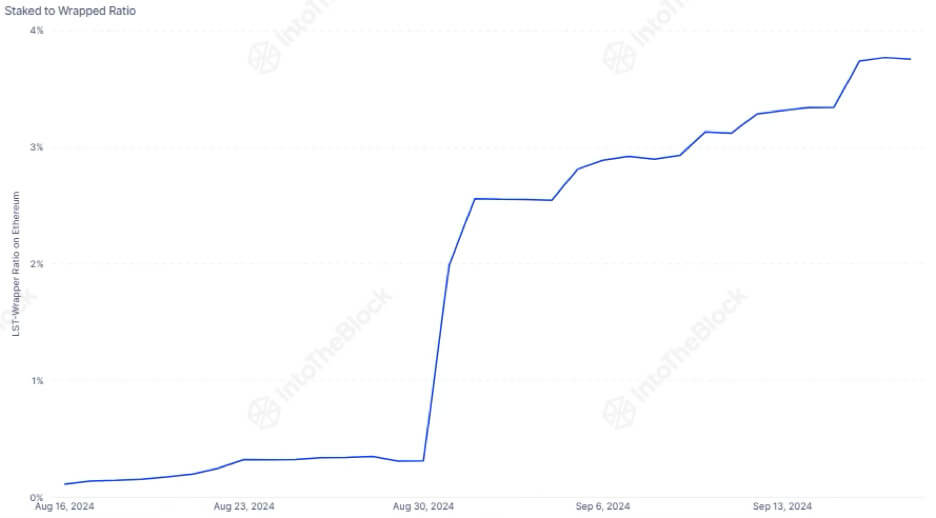

Bitcoin staking has had a strong start, with thousands of holders already earning points through major protocols. Currently, Stake Bitcoin represents 3.75% of all wrapped Bitcoin.This suggests there is still plenty of room for growth in the coming months.

While the concept is promising, long-term success depends on whether the economics of staking make sense beyond the initial point rewards. The key is the development of services built on top of these protocols. With a robust ecosystem of services developed, Bitcoin staking could become one of the most attractive yield opportunities for Bitcoin holders.