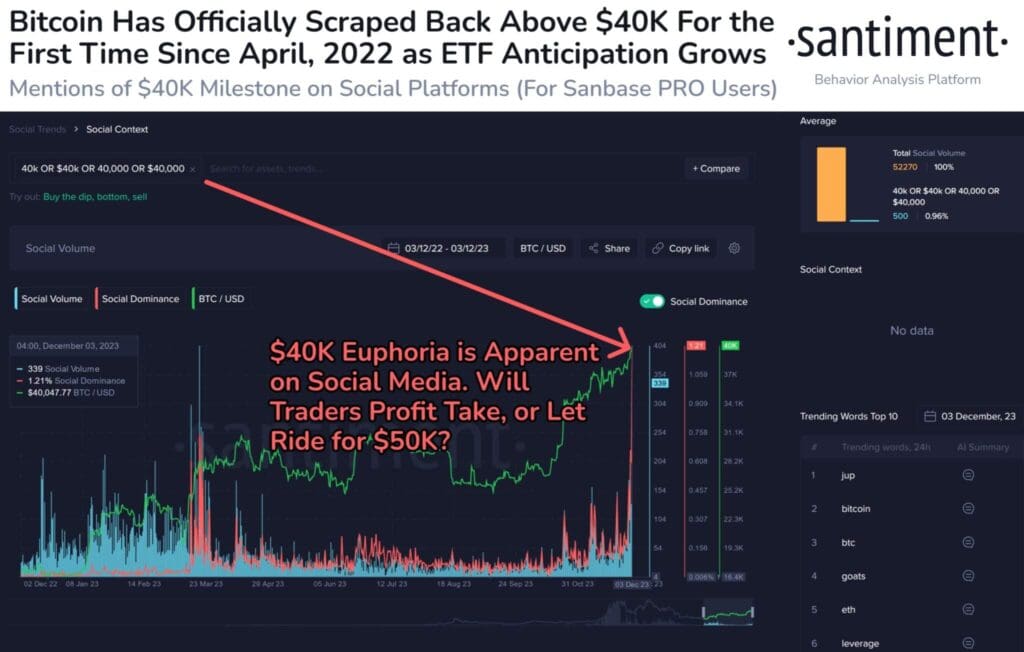

- Bitcoin and Ethereum set new records in December 2023, further intensifying the focus on resistance and support levels within the cryptocurrency market.

- Factors such as signs of cooling inflation, the Federal Reserve’s conclusion to raise interest rates, and expectations for Bitcoin ETFs are contributing to strengthening confidence in the future of the cryptocurrency industry.

In the ever-evolving cryptocurrency landscape, the current December wave has brought a whirlwind of developments. The focus on deciphering resistance and support levels has intensified as Bitcoin (BTC) and Ethereum (ETH) take center stage by shattering 2023 records. At the same time, speculative discussions about Bitcoin’s trajectory continue, causing ripples throughout the cryptocurrency space.

Bitcoin’s Rapid Rise: Breaking Down Barriers and Charting a New Trajectory

The incredible surge in Bitcoin’s value has taken the cryptocurrency to unprecedented heights, surpassing $41,500. In particular, Crypto4Every₿ody, a prominent figure in the cryptocurrency space, highlighted the unexpected nature of this surge and pointed out new resistance and support levels following the BTC price surge.

Bitcoin’s unexpected rise has sparked tremendous enthusiasm and has the industry looking forward to the upcoming benchmark. According to Crypto4Every₿ody’s analysis, important breakpoints lie at the resistance level at $43,100 and support at $39,400, attracting the attention of traders and enthusiasts alike.

Read more: Bitcoin Surpasses $41,000: What’s Next for the Crypto Rally?

Strengthening Trust in Cryptocurrencies: Factors and Forecasts

The growing confidence in the cryptocurrency market is due to several key factors, including signs of declining inflation and the general belief among investors that the Federal Reserve has concluded its series of interest rate hikes. Moreover, within the cryptocurrency space, there is a distinct expectation for updates to applications submitted by major players such as: black stone, There is competition for the possibility of introducing a U.S. spot Bitcoin ETF.

A recent report from Matrixport revealed a bullish trajectory for Bitcoin, with a surge to $63,140 by April 2024 and an eye-popping forecast of $125,000 by December 2024. These predictions have injected additional enthusiasm into the ongoing Bitcoin rally, painting an optimistic outlook for the future. of the cryptocurrency market.