Solana (SOL) price is on the verge of a massive rally after facing significant selling pressure at the strong resistance level of $161. In the past few days, SOL has fallen by more than 18% due to the overall bearish market sentiment and the recent price decline of Bitcoin (BTC).

Trend reversal signal

However, the daily chart of SOL has formed a bullish divergence, signaling a potential trend reversal from a downtrend to an uptrend. Since early August 2024, SOL has been forming lower lows, while the Relative Strength Index (RSI) has been forming higher lows.

A bullish divergence forming on the daily time frame indicates a potential bullish rally. Traders and investors see this as an ideal buying opportunity.

Solana Price Prediction

According to the technical analysis of experts, SOL is consolidating in a narrow range near the important support level of $127. This support level has always been special for Solana. Since March 2024, SOL has revisited this level several times, and each time it has shown a huge upward rally of at least 20%.

However, given the bullish divergence and past price momentum, there is a good chance that SOL could surge 20% to $161.

On-chain indicators and market sentiment

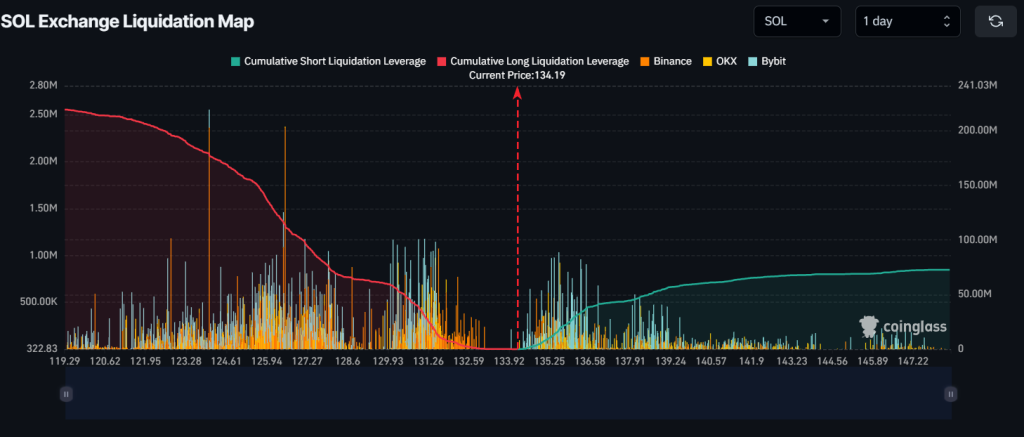

According to Coinglass, an on-chain analytics firm, the current major liquidation levels are $126.50 for the bottom and $136.80 for the top, as traders are overleveraged at these levels.

If market sentiment for SOL remains bullish and the price rises to the $136.8 level, approximately $41 million worth of short positions will be liquidated. Conversely, if sentiment changes and the price falls below the $126.5 level, approximately $115 million worth of long positions will be liquidated.

High long liquidations indicate that the asset is currently dominated by strength and there is potential for larger short positions to be liquidated.

At the time of writing, SOL is trading near $134 and has seen a price surge of more than 3% in the last 24 hours. Meanwhile, volume has also surged by 65% in the same period, showing increased participation amidst the bullish outlook.