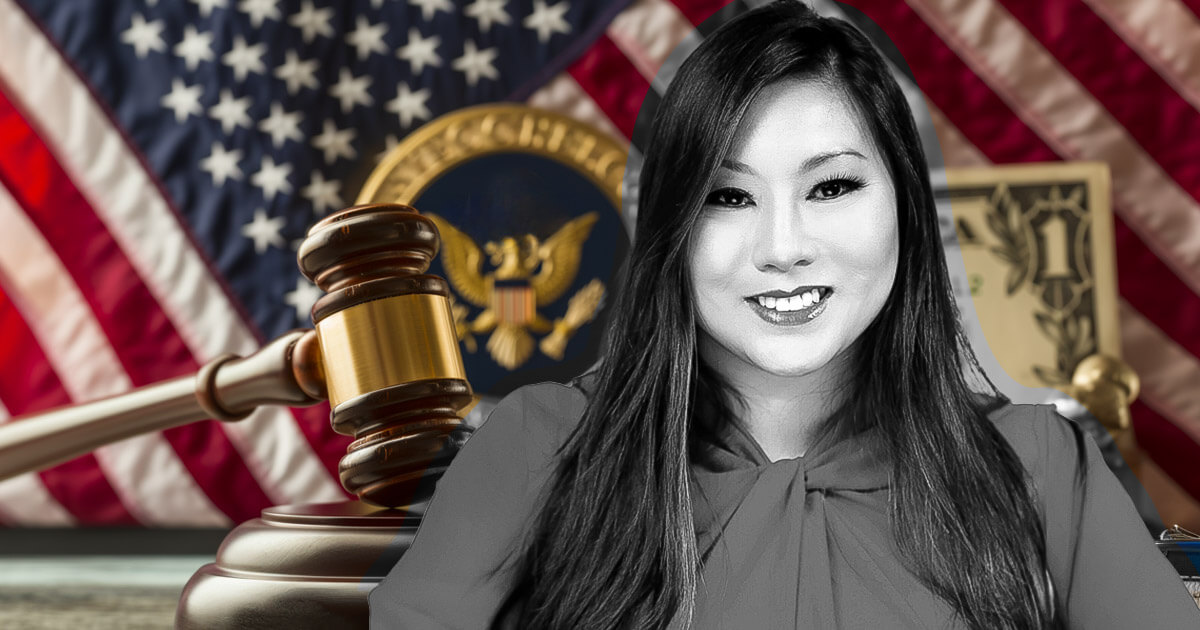

CFTC Commissioner Caroline Pham said on March 29 that her agency’s prosecution of KuCoin may violate the SEC’s duties.

Pham acknowledged the CFTC case as an “aggressive enforcement action” and praised the agency’s actions. However, she raised concerns about some of the allegations.

A distinction is needed

According to Pham, the complaint suggests that fund shares held by investors may themselves be a form of leveraged trading.

She said this interpretation does not distinguish between investments in funds that are generally considered securities under SEC jurisdiction and the fund’s trading activities that fall under CFTC jurisdiction.

She emphasized the need for distinction when she wrote:

“Owning stocks is different from trading derivatives.”

Pham added that the CFTC’s handling of the matter “could undermine the SEC’s authority,” undermine investor protection laws and disrupt securities market fundamentals.

Some commentators have previously observed that the case names Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC) as commodities, potentially excluding those tokens from SEC jurisdiction. Pham’s statement does not address this exact issue.

KuCoin claimed this week

The CFTC filed civil charges against KuCoin and related companies on March 26 for operating an illegal digital asset derivatives exchange and, more broadly, for violating regulations. Commodity Exchange Act (CEA) due to failure to register with CFTC.

The U.S. Department of Justice has also filed criminal charges against KuCoin and two of KuCoin’s founders, including but not limited to charges of violating anti-money laundering laws.

KuCoin responded to the allegations by assuring users that their funds would remain safe and claiming it complies with various local laws. The company said its lawyers were reviewing the claims.

The post KuCoin Charges May Violate SEC Powers appeared first on CryptoSlate, CFTC’s Caroline Pham said.