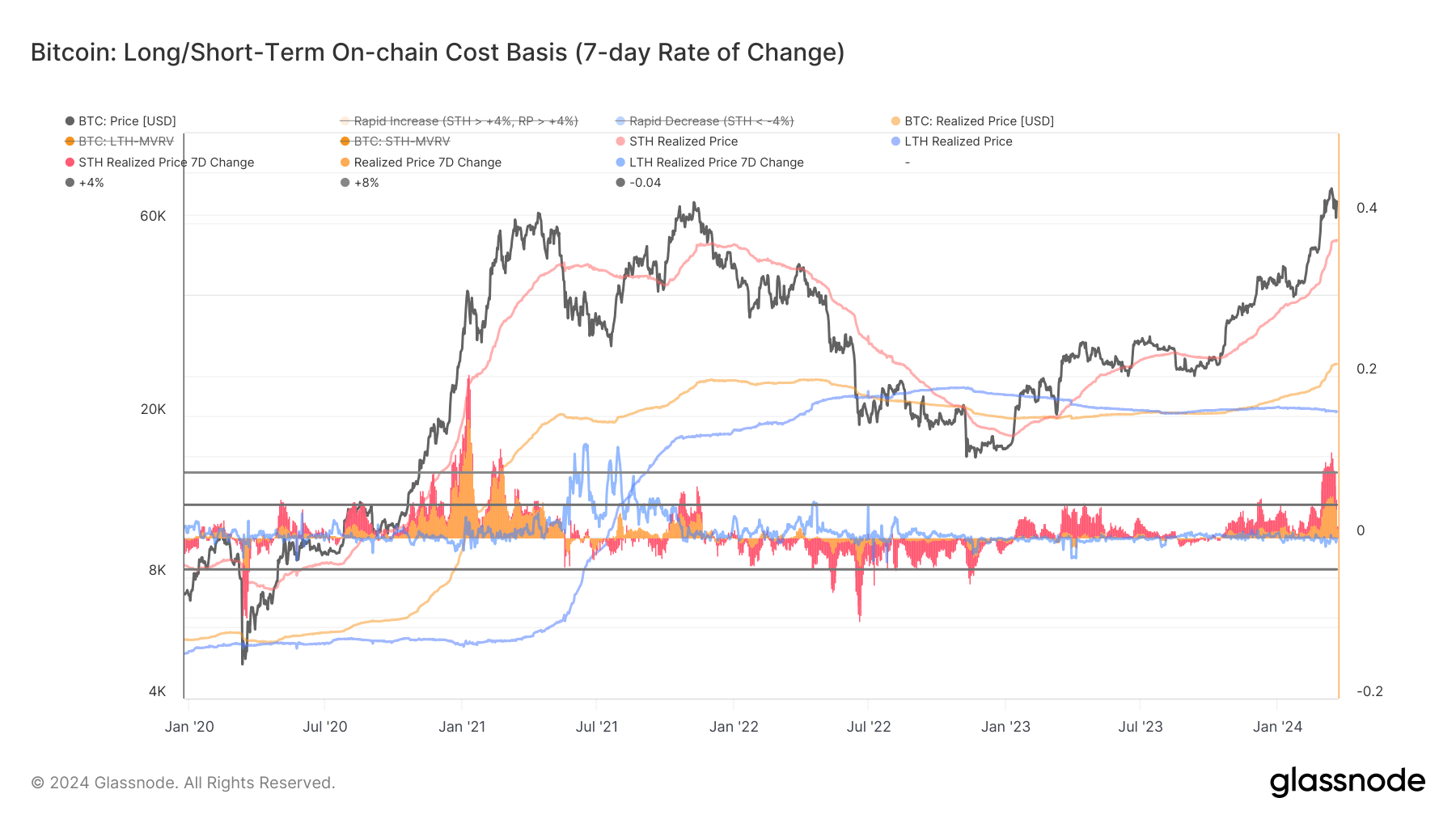

The realized Bitcoin price represents the average on-chain acquisition cost. It is a convenient metric as it provides a complete measure of the market’s valuation baseline at any given point in time. Analysis from the perspective of short-term and long-term holders provides insight into the investment horizon of the group and the drastic impact this may have on the price of Bitcoin.

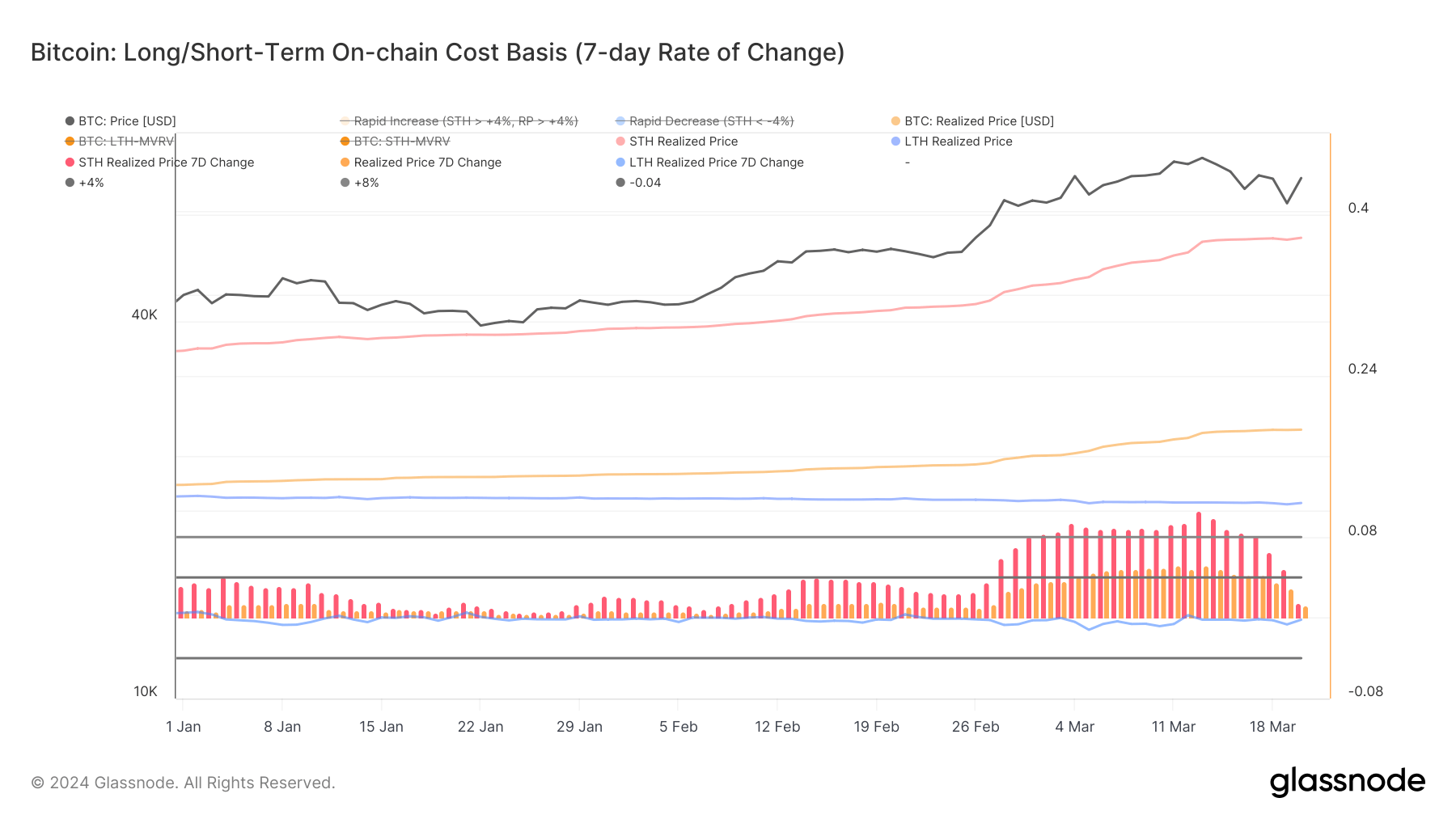

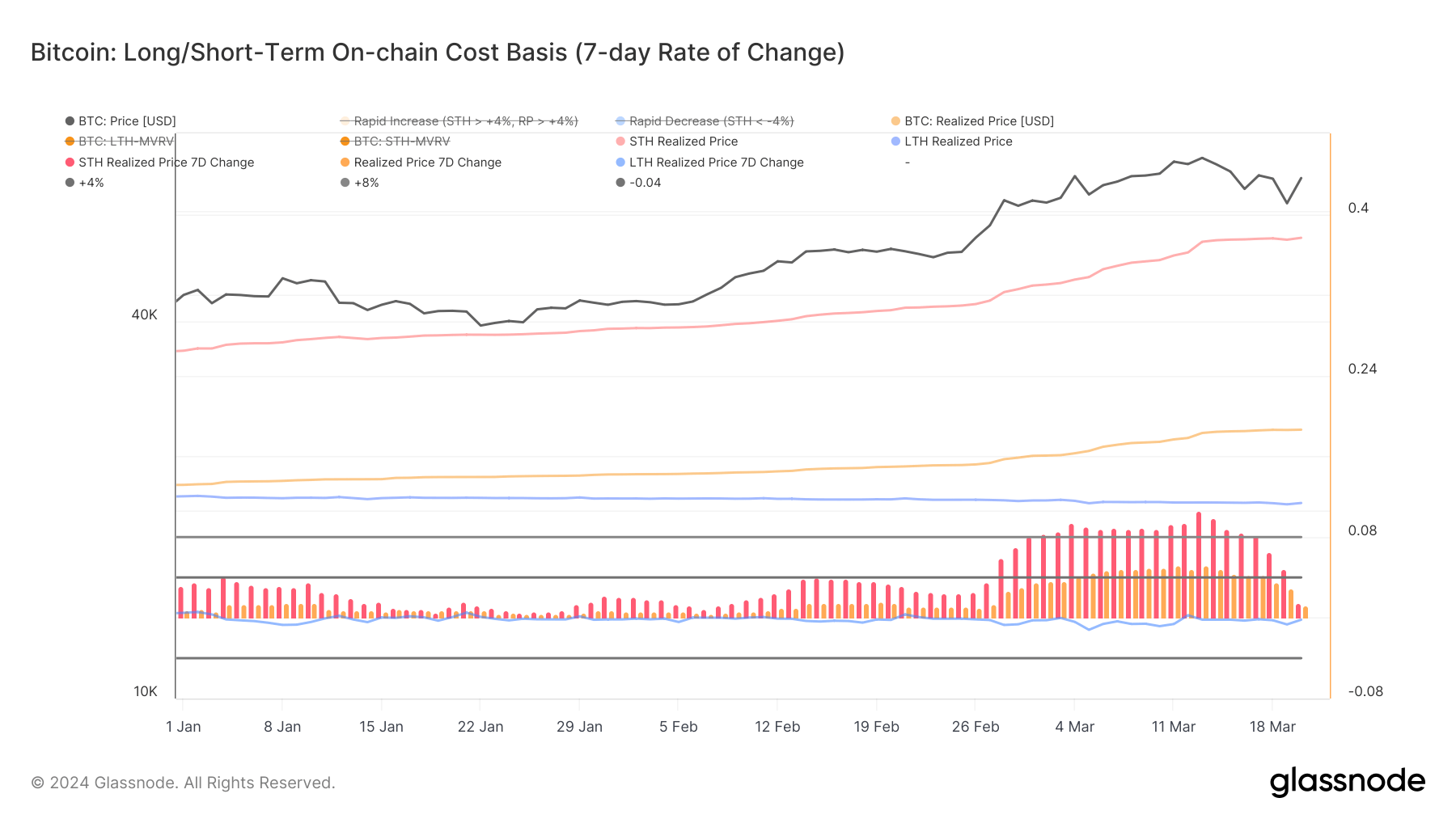

The 7-day realized price change for these cohorts provides a much better visualization of the metric. The seven-day change in realized prices for short-term holders hit a three-year high of 10.62% on March 13. On the same day, the 7-day change rate of long-term holder realized price was -0.183%, a slight decrease compared to the previous week.

This difference between STH and LTH realized prices suggests a strong influx of short-term speculative interest into the market. From March 6 to March 13, new market participants entered at higher price levels than long-term holders, driving the realized price higher for the group. The rise in STH realized prices, which peaked on March 13 when the price of Bitcoin peaked above $73,100, means significant investments were made at or near the peak prices.

Tracking changes in realized prices for both LTH and STH is very important because of its ability to reveal changes in market sentiment and potential pressure points. For example, a rise in the realized price of STH, especially in conjunction with an increase in the price of Bitcoin, could signal increased optimism or speculative demand as new entrants are willing to invest at higher price levels. Relatively stable or declining LTH realized price changes suggest holding sentiment among long-term investors who may not move their holdings despite price fluctuations, anchoring the market’s underlying value perception.

Glassnode’s data showed a market at a potential inflection point. The sharp increase in STH realized a price change along with a significant rise in the price of Bitcoin, indicating a short-term bullish sentiment driven by speculative trading and new entrants attracted by its momentum. However, sharp spikes, as seen on March 13, rarely last for more than two weeks before experiencing significant corrections, which is what happened just last week.

The 7-day movement for short-term holders realized that Bitcoin fell to $61,000 and then recovered to $68,000, with the price down 1.469% by March 20th. This sharp decline indicates that speculative enthusiasm has cooled and the market has entered a consolidation phase. According to the data, the buying momentum and optimism that led to a significant increase in STH realized prices further moderated Bitcoin prices, leading to a more cautious market sentiment.

Several interpretations can be drawn from this data point. First, the declining rate of change in STH realized prices may indicate a slowdown in new capital inflows at higher valuation levels. The STH realized price change and the simultaneous decline in the Bitcoin market price may suggest reduced sell-side pressure from short-term holders.

Typically high STH realized price movements, especially when they hit a record on March 13, may indicate increased selling activity potential as short-term holders look to capitalize on profits. However, once these pressures subside, prices may stabilize, albeit at levels below recent highs, as the market absorbs the impact of previous speculative trading.

Going forward, this rebalancing period could pave the way for resistance to form at this price level as it allows the market to digest the recent uptrend. Moreover, the behavior of long-term holders will be an important factor to monitor on an ongoing basis, as remaining consistent amid volatility often serves as an anchor for market stability.