The distribution of Bitcoin supply across different populations, including shrimp, crabs, fish, sharks, and whales, can help us understand how each market segment behaves. Changes in Bitcoin supply among these groups are closely correlated with price movements and broader market trends, making it essential to understand them when analyzing the market.

Shrimp represents retail investors holding less than 1 BTC, a measure of grassroots participation in the Bitcoin market. The crabs include retail-sized investors who hold between 1 and 10 BTC, and are often considered informed long-term holders.

Fish to Shark includes high-net-worth individuals and institutional investors holding between 10 and 1,000 BTC, a category that reflects both early adopters and professional trading operations.

Lastly, whales hold between 1,000 and 10,000 BTC, and their movements are closely monitored because they have a large impact on the market.

Tracking changes in supply distribution across these cohorts can provide valuable insight into Bitcoin’s liquidity and the strategic positioning of different investor classes.

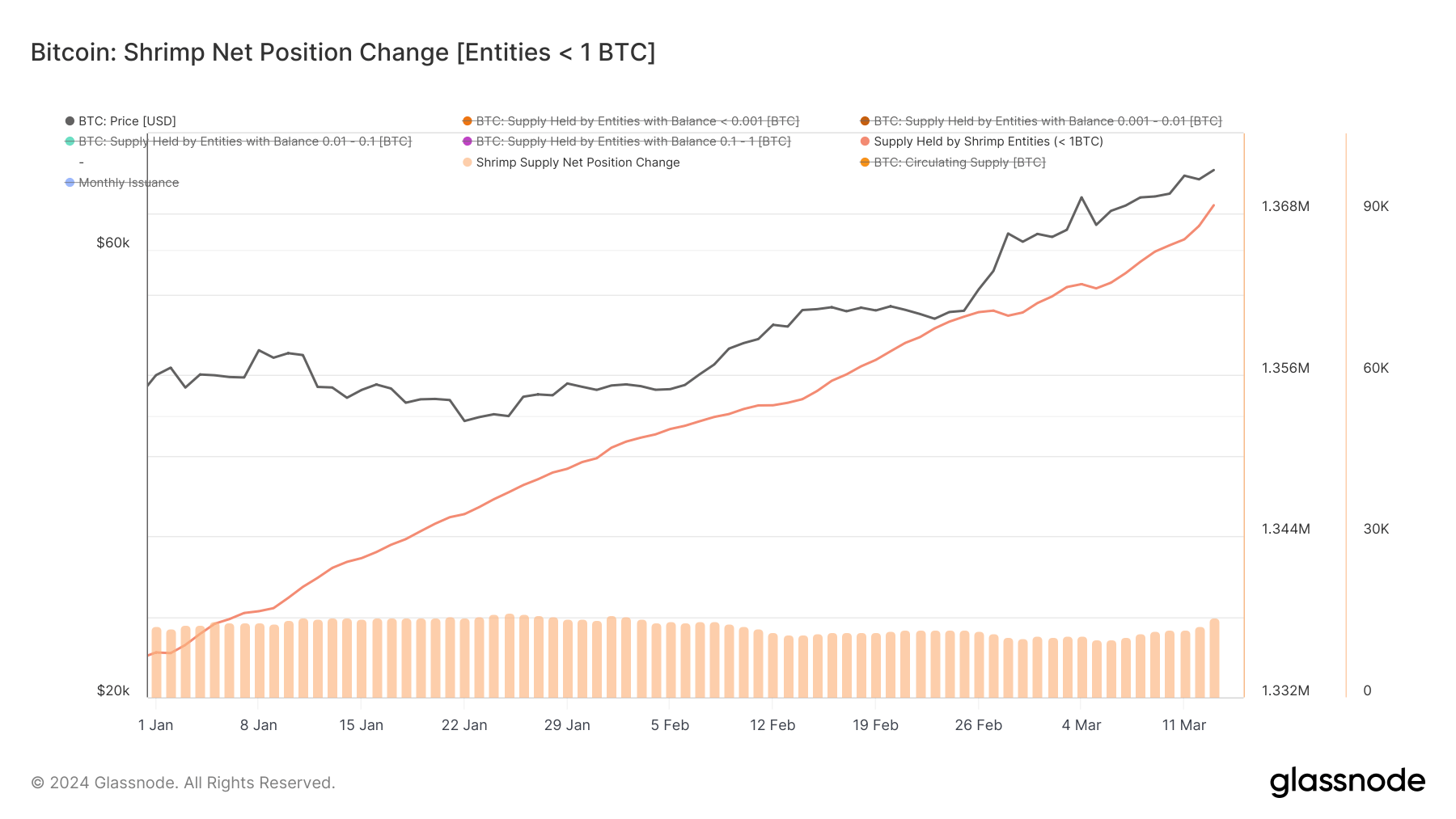

From January 1 to March 13, Shrimp’s Bitcoin holdings increased from 1.335 million BTC to 1.368 million BTC. This consistent growth despite price fluctuations suggests a dollar-cost averaging strategy in which small, regular purchases are made regardless of asset prices.

This behavior signals a deep-rooted belief in the long-term value of Bitcoin among retail investors, confirmed by their continued investment despite market uncertainty.

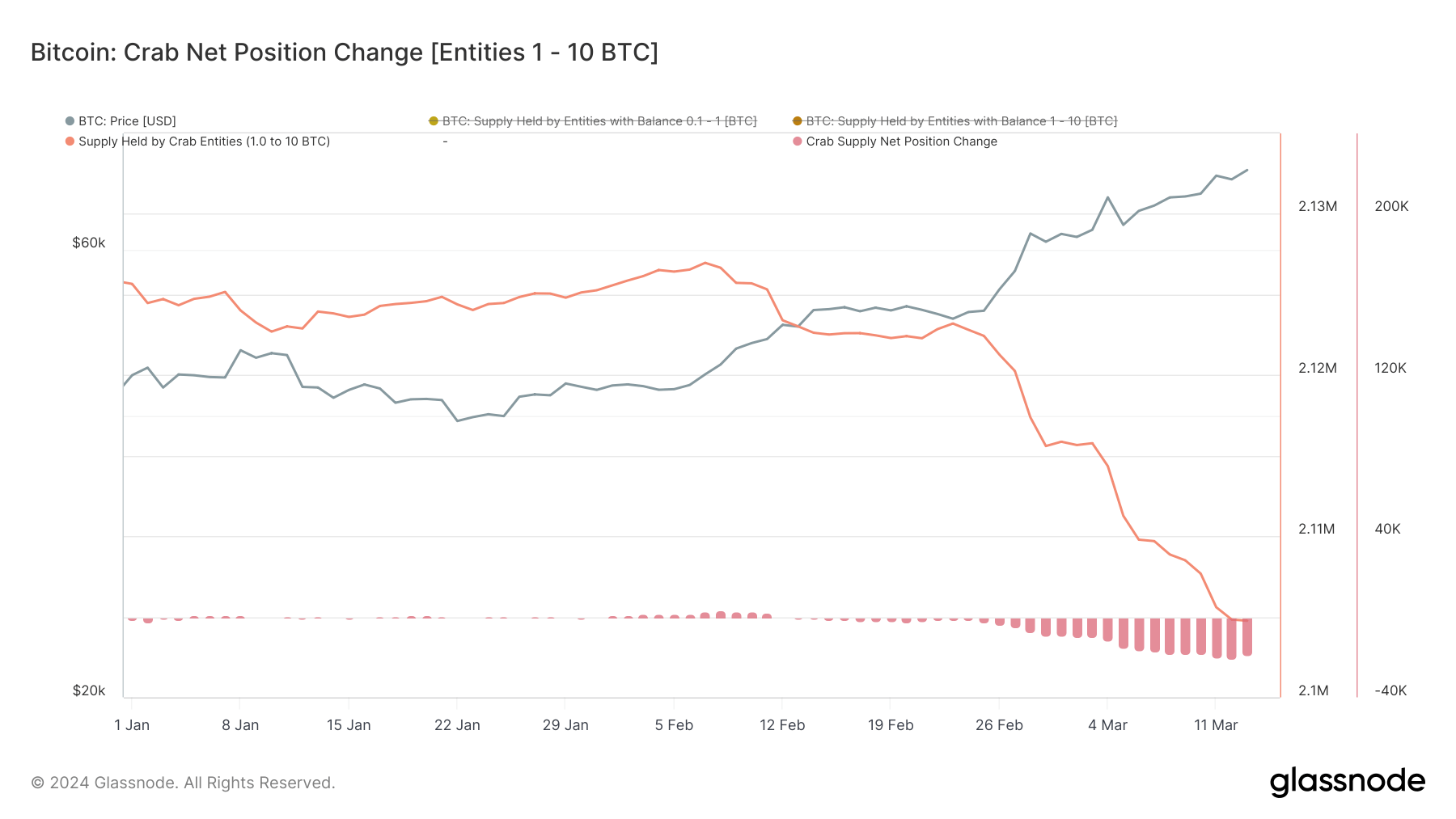

The holdings of the Crab group (individual investors who typically hold more capital or have accumulated over time) decreased slightly from 2.125 million BTC to 21.04 million BTC.

The decline, especially around March 12, may be in response to price volatility, allowing you to take profits or minimize losses. This suggests that while Craps is committed to investing in Bitcoin, he is sensitive to market fluctuations and is prepared to adjust his positions in response to perceived risk.

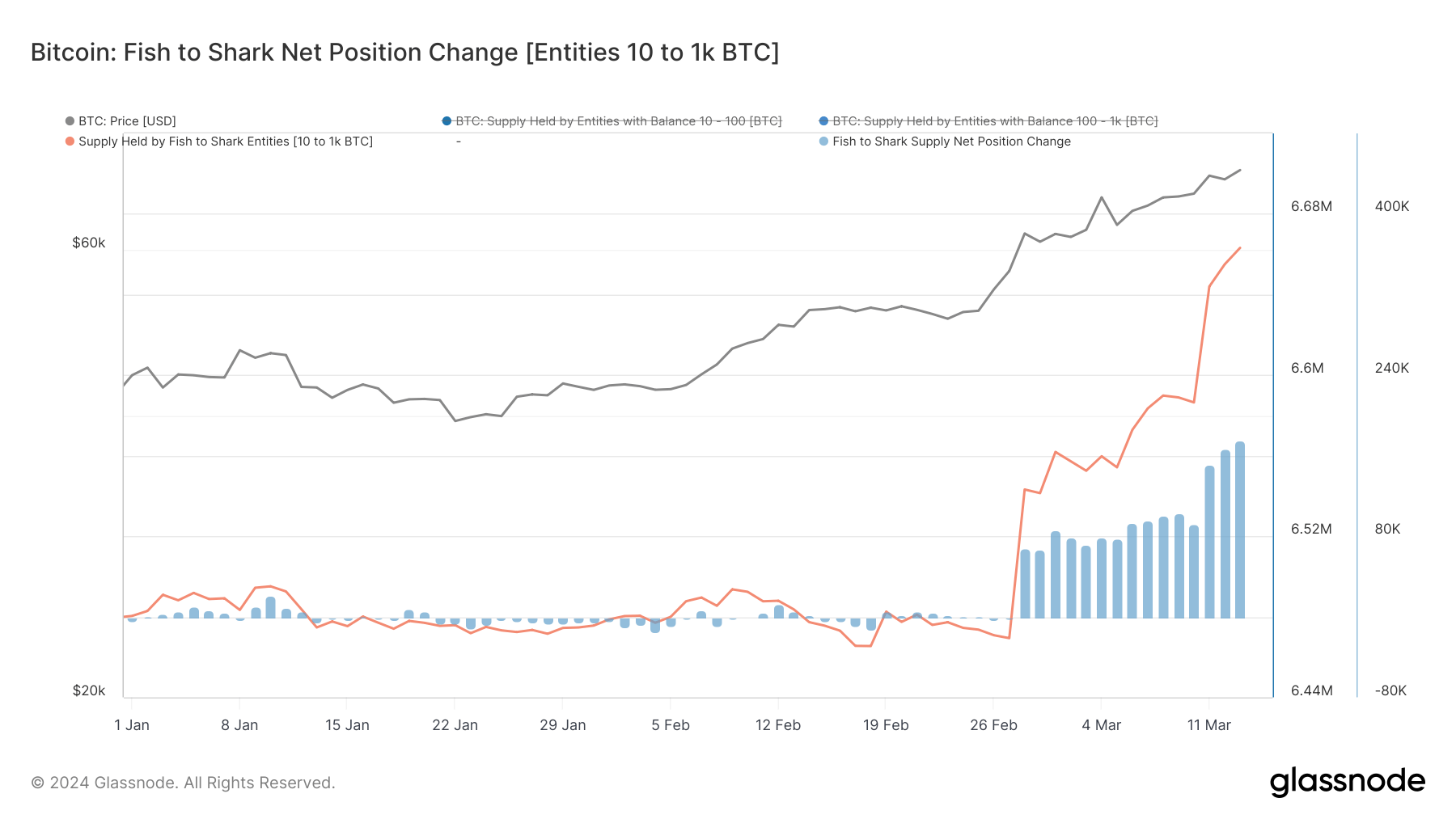

Fish-Shark cohort holdings increased from 6.48 million BTC on January 1 to 66.63 million BTC on March 13, a fairly positive change over the course of a month.

This represents strategic accumulation by high-net-worth individuals and institutions leveraging spot Bitcoin ETF adoption and anticipated market growth. The behavior of this group reflects that of financially significant players whose confidence can sway markets.

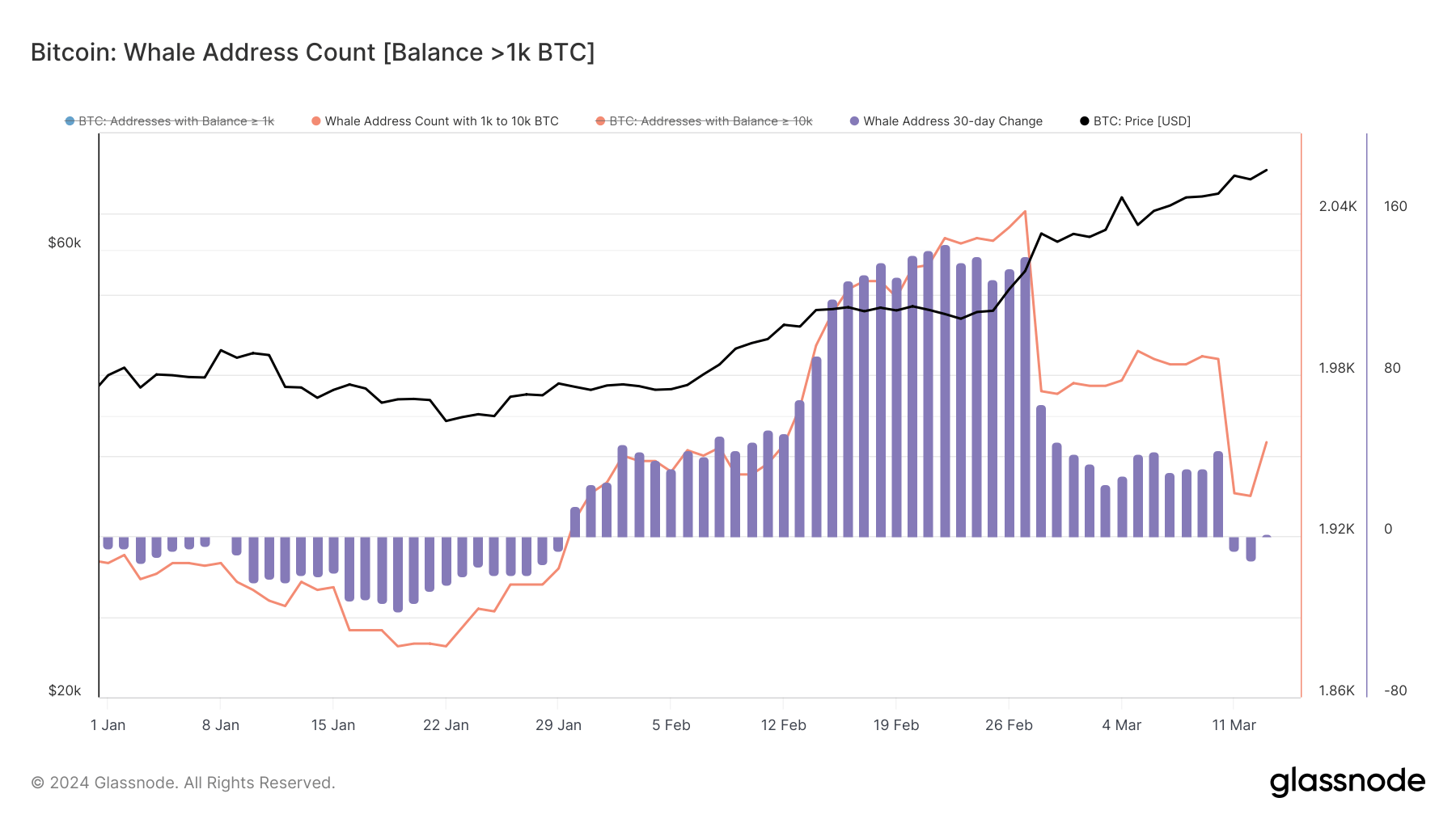

The whale population fluctuated widely, peaking at 2,041 in February and then declining to 1,955 on March 13. These changes suggest profit taking or portfolio adjustments to account for strong market trends.

Whale movements are critical to market direction given their significant holdings and influence on market liquidity and sentiment.

Glassnode’s data revealed distinct strategies across these groups, revealing different perceptions of risk, investment horizons, and reactions to market movements.

Surprisingly, the shrimp showed strong faith in Bitcoin and continued to increase their holdings. Meanwhile, craps, which is generally stable, appears ready to react to market signals by adjusting position sizes in response to price fluctuations.

Fish and sharks appear to have been the groups that most utilized the launch of spot ETFs in the US. Market optimism following the long-awaited trading product has significantly shifted the size of supply held by these groups, demonstrating the growing confidence institutions and high-net-worth individuals have in Bitcoin.

Meanwhile, whales showed their characteristic strategic flexibility with a slight decline in numbers pointing to a cautious approach in a bullish scenario.

The post From shrimp to whales: who is buying and selling in this rally? First appeared on CryptoSlate.