In this post, we will focus on monitoring settings for both long and short positions. It’s a quick way to explore and plan potential trades through charts and short articles.

Stocks yawned on a hotter-than-expected inflation report. The consumer price index in February rose 3.2% compared to the same period last year. The core bill, which excludes food and energy prices, rose 3.8%. both figures It was higher than economists’ estimates and recent trends are worrisome. also. The three-month annualized increase in the key indicator has now increased to 4.3% (chart below). The monthly CPI report has become one of the most widely anticipated economic releases due to its implications for monetary policy. Federal Reserve officials are looking for more evidence that inflation is low before cutting interest rates.. nevertheless Market implied odds supporting a June rate cut were little changed after CPI. As I mentioned here.

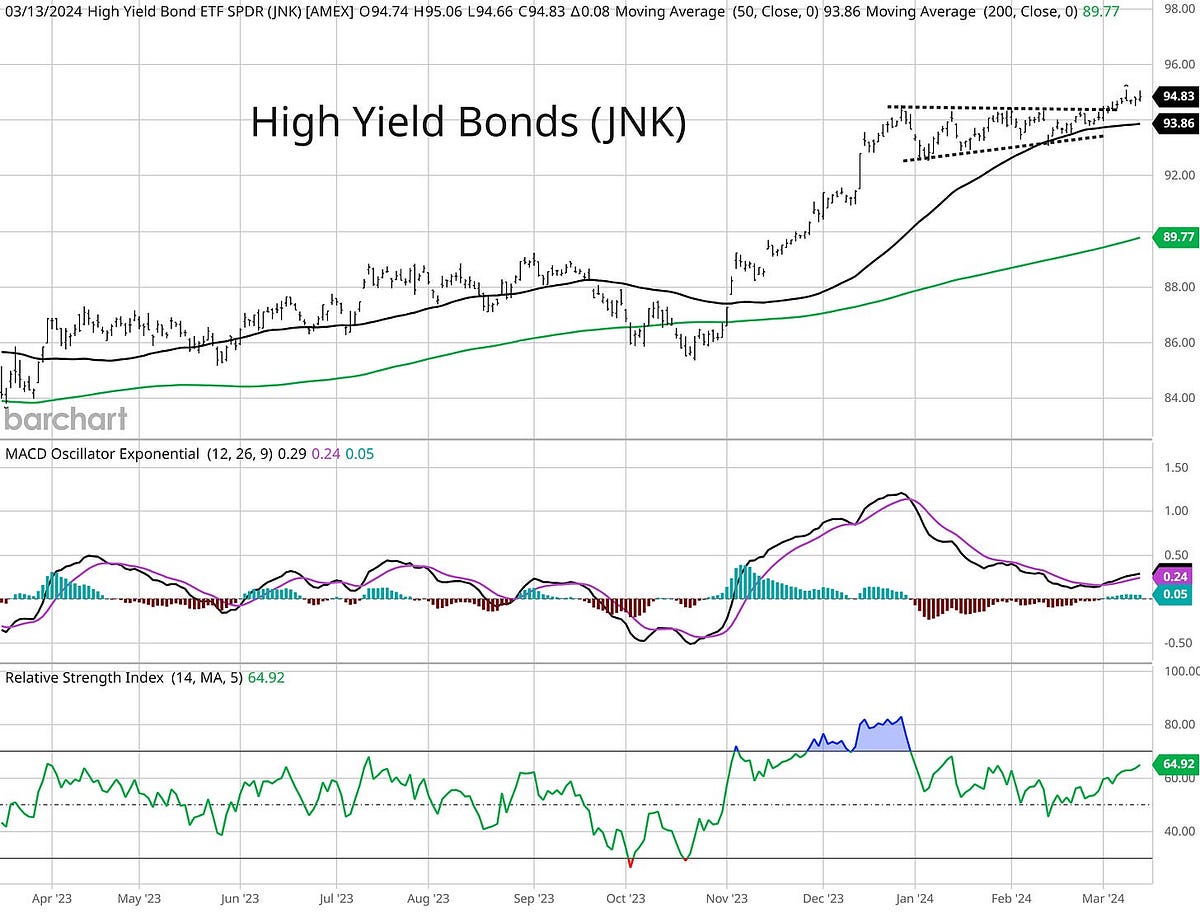

but The stock market largely ignored the inflation report., which did the exact opposite of what was expected. Stocks closed with strong gains across the board on Tuesday, with the growing Nasdaq Composite Index up 1.5% on the day. But as I recently mentioned, Activity in other areas of the stock market, which are more speculative and sensitive to economic developments, is encouraging.. It’s like the breakout of small-cap stocks that bottomed out two years ago or the upward movement of retailers. Now there’s another breakthrough to add to the list, and that’s high yield bonds. JNK Exchange Traded Fund (ETF) High yield bonds have recently been breaking out of the ascending triangle pattern. This dates back to the end of December (chart below). The rise puts JNK just below its previous high, while HYG is another high-yield ETF that is breaking from a similar pattern and heading toward new all-time highs.

A move toward higher returns It adds more weight to the evidence that this bull market still has room to run.. There may be a downturn along the way, but given the improving rate of change in key economic data, the 52-week high net new highs, the huge surge late last year, and cyclical sectors (such as semiconductors and home building), stocks could continue to rise. We are leading the way and are now seeing speculative breakthroughs in areas such as small-cap growth and high yields. In my opinion, The market is discounting a strong economy ahead, which should be positive for the earnings outlook. Not only that, and This offsets concerns about monetary policy. now. Additionally, this is creating a trading environment that continues to support a breakout. This week I will be removing CAVA and IOT from my watchlist as both stocks are rising and completing chart patterns. That means there are a few new additions to the list this week.

Continue reading below for all updates…

lee

This setup takes more time to get set up, but I wanted to add it to my watchlist. The stock moved quickly to test resistance at its post-IPO high of $45. Pulling back resets MACD. I would also like to see the Relative Strength (RS) line improve before attempting a breakout.

MPTI

It has been testing resistance near the $44 level since early January, forming an ascending triangle pattern. The MACD has recently reset in recent tests and the RS line is hovering near its highs. We are watching for a break above $44.

NXT

After breaking the $50 level, the stock traded sideways, allowing the MACD to reset at the zero line. While the RS line is holding near the highs, I would like to watch on a more time-based basis before it breaks the $60 level to new highs.

Cube

It consolidated gains after hitting $60 in late December. On any breakout attempt, I would like to see the RS line break above its December high. A rise above $60 could target previous highs in early 2022.

road

We are trying to get out of the base we hit bottom almost two years ago. I’ve been building on the stock since December after it broke the $20 level. I don’t want to see support at $21 which would invalidate the pattern. We are watching for a move above $27.

STNE

I started coming out of a base that hit rock bottom two years ago. Resistance at $15 has been removed and gains have now been consolidated. It has been trading sideways since late December with a new resistance level near the $19 level. I would like to see support with a $16 hold in the pattern.

BX

Since peaking in 2021, the chart has been showing a large dish pattern. The price recently reached $140, close to its previous high, but is currently on a downward trend. This will reset the MACD while the price holds support at $115. We are watching for a move to new highs above $140.

Not this week!

- I trade chart breakouts based on the daily chart for long positions. And in long-term setups, I tend to wait until the last 30 minutes of trading to add positions if they are price triggered. I find that emotional money trades at the open price and smart money trades at the close. If a stock appears to be plummeting, you don’t want to have a “head fake” in the morning and then a downtrend later.

- We also use the RS line as a breakout filter. I find that this improves the quality of price signals and helps prevent false breakouts. Therefore, when the price breaks out of the chart pattern, we want to see the RS line (the green line in the bottom panel of the chart) as a new 52-week high. Conversely, I prefer the RS line to create a new 52-week low for a short-term setup.

- Additionally, for long positions, we use the 21-day exponential moving average (EMA) as a stop. During the last 30 minutes of trading, if it looks like your position will be closed according to the 21-day EMA, you will typically take a loss or sell to take a profit.

- For sell (or put) positions, use the 4-hour chart instead of the daily chart. why? There is a saying that stocks go up when you take an escalator and go down when you take an elevator. Profitable trades start taking profits when the 4-hour MACD starts to become oversold. I take profits more actively from short positions as there is nothing like a short rally to see your profits evaporate quickly. I also use the 21-day EMA on the 4-hour chart as a stop. If the price closes above the 21-day EMA, it tends to cover the short position.

Visit here for updated charts, market analysis and other trading ideas. www.mosacassetco.com

Disclaimer: This is not a recommendation, just my thoughts and opinions. Do your own due diligence! I may hold positions in securities mentioned in this post.