CryptoQuant says miners appear to be starting to offload their Bitcoin holdings as the fourth halving approaches.

As Bitcoin (BTC) continues its upward trend and the fourth halving approaches, miners have begun selling their holdings in cryptocurrency and monetizing their business operations to purchase more equipment for profitability. Kiyoung Ki-young, CEO of CryptoQuant, revealed a graph of miners’ selling activity since 2012 through XPost on the 13th and said, “As long as the inflow of ETFs (exchange-traded funds) does not slow down, the bull market will continue.”

In a follow-up post, the CryptoQuant CEO pointed out that U.S. mining companies have not been major Bitcoin sellers so far, suggesting that top sellers “are likely to be overseas or older miners.”

Bitcoin miners often sell their holdings before halvings to lock in profits, mitigate price volatility risk, diversify assets, and reinvest in mining infrastructure, which increases market volatility before and after halvings.

However, analysts are confident that increased selling activity by miners is unlikely to disrupt Bitcoin’s upward momentum, given the significant inflow of new capital through spot ETFs. Coinbase Research analysts say the current price surge is “just the beginning of a long-term bull market,” adding that “billions of dollars of net inflows (into spot Bitcoin ETFs) in just two months have irreversibly changed the situation.” “He added.

Despite Bitcoin miners achieving a record daily profit of $78.6 million, surpassing the previous high set during the 2021 bull market, the performance of public mining companies paints a different picture.

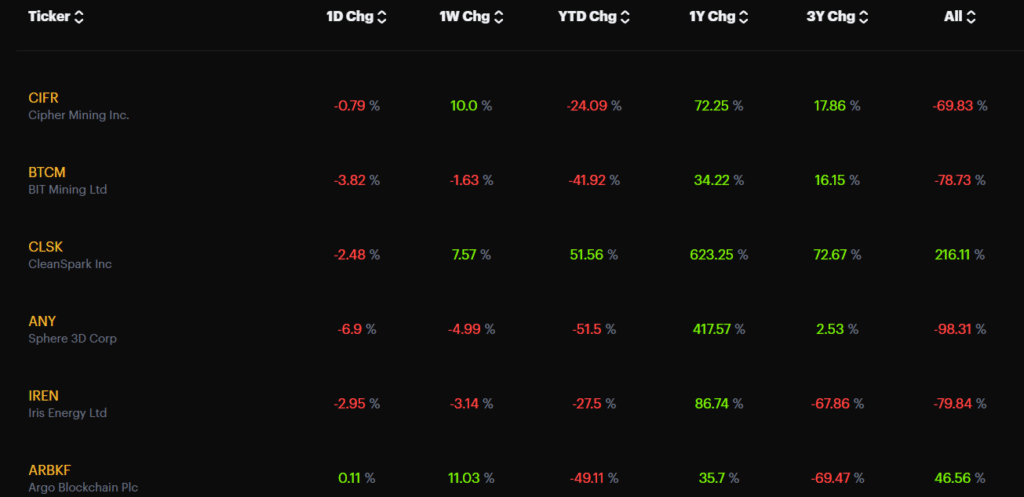

According to Hashrate Index data, only three of the 26 public Bitcoin miners have recorded positive returns so far this year. CleanSpark (CLSK) was up 51.5%, Investview (INVU) was up 25.7%, and Northern Data (NB2) .DEX) was up 7.52%. As crypto.news previously reported, Bitcoin’s fourth halving is expected to arrive in mid-April this year, reducing the block reward from 6.25 BTC to 3.125 BTC.