The European Central Bank is moving forward with plans to launch a digital euro, with the aim of providing a pan-European digital payments solution that complements cash, according to ECB Executive Board member Piero Cipollone. According to a note published on March 13, Cipollone explained the basic design choices and rationale of the Digital Euro project at the Convegno Innovative Payments conference.

As evolving payments trends reflect people’s growing preference for digital payments, the ECB wants to make life more accessible by providing a public digital payment instrument that is free to use for all digital transactions in the euro area. Cipollone emphasized that the digital euro will bring cash-like features to the digital world. This means that it can be used offline, is free for basic use, and respects privacy while maintaining pan-European coverage.

However, some critics have raised concerns about the digital euro’s impact on privacy. In a recent post, WalkerAmerica, host of the Bitcoin-focused Titcoin Podcast, expressed skepticism about the ECB’s privacy claims.

“The ECB plans to launch a digital Euro CBDC from 2025. They claim it will be ‘private’, but considering Lagarde already wants to put you in jail for anonymous cash payments of over €1000, that probably won’t be the case. “Study #Bitcoin and reject this totalitarian surveillance token.”

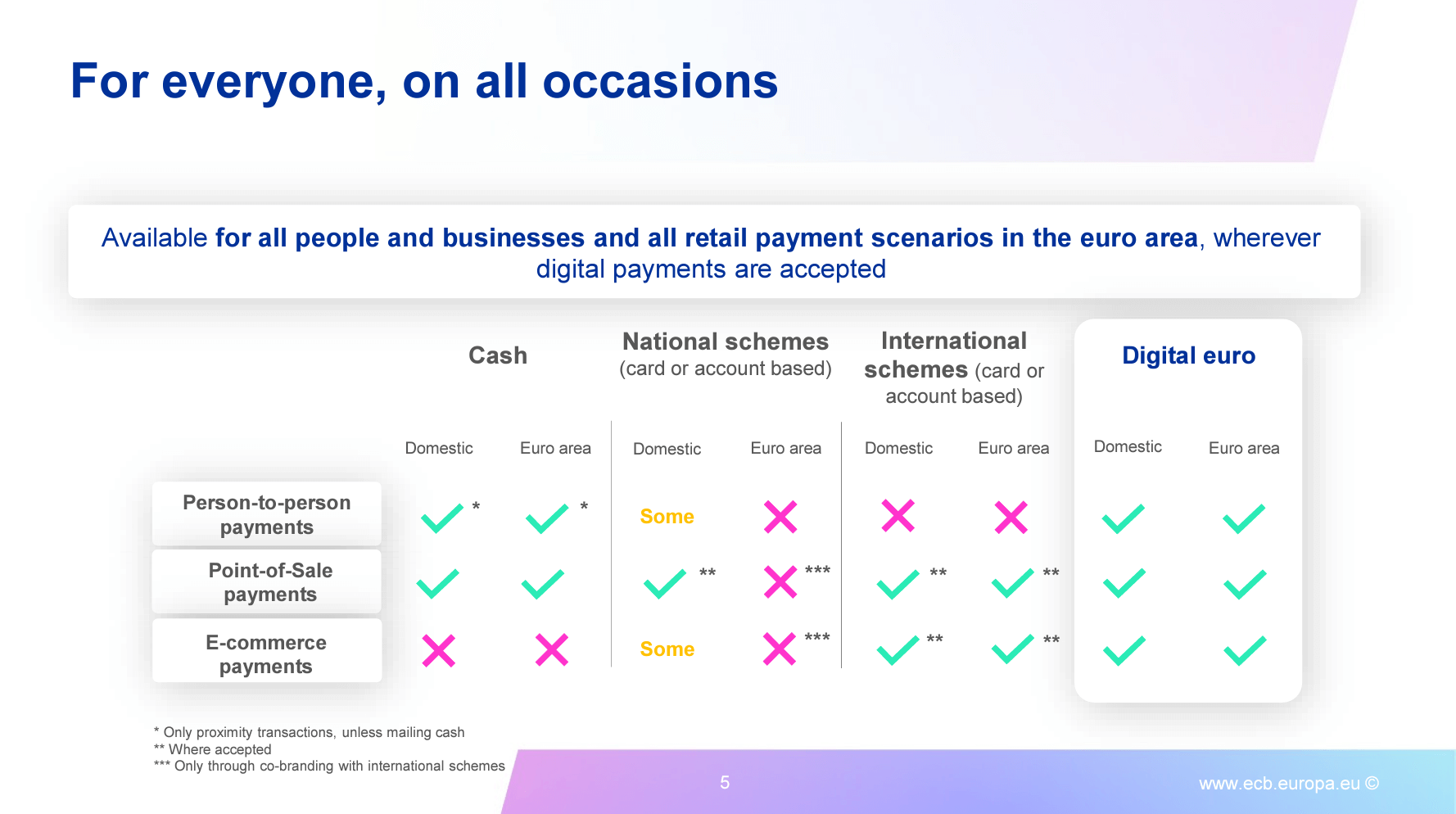

According to the released slides, the Digital Euro is designed to be accessible to everyone, including individuals and businesses, and covers all retail payment scenarios in the euro area where digital payments are accepted. Cipollone highlighted the current lack of European digital payments instruments that cover all euro area countries. Thirteen out of 20 countries rely on the international regime for digital payments to settle 69% of all digital transactions in the EU. The Digital Euro aims to fill this gap by providing a standardized digital payments platform for the entire euro area.

To address the issue of inclusivity, Cipollone pointed out that digital euro payments can also be made using physical cards, while cash is used for financing and refunding funds. Users have access to face-to-face technical support and are also given the option to easily switch intermediaries. Selected public institutions also act as intermediaries for users without bank accounts.

Data protection and privacy are known to be key priorities of the Digital Euro project. Eurosystem implements safeguards to ensure high data protection standards, including internal data separation and auditing. Once the large-scale payment system is ready and tested, innovative privacy technologies will be adopted, creating higher privacy standards for digital euro users.

However, the cryptocurrency industry is less optimistic about this. “Cash is anonymous and uncensorable,” said Bitcoin writer Quinten Francois. The digital euro is not like that.” Also in February, Cipollone addressed the European Parliament’s Economic and Monetary Affairs Committee to allay concerns about the security of the digital euro.

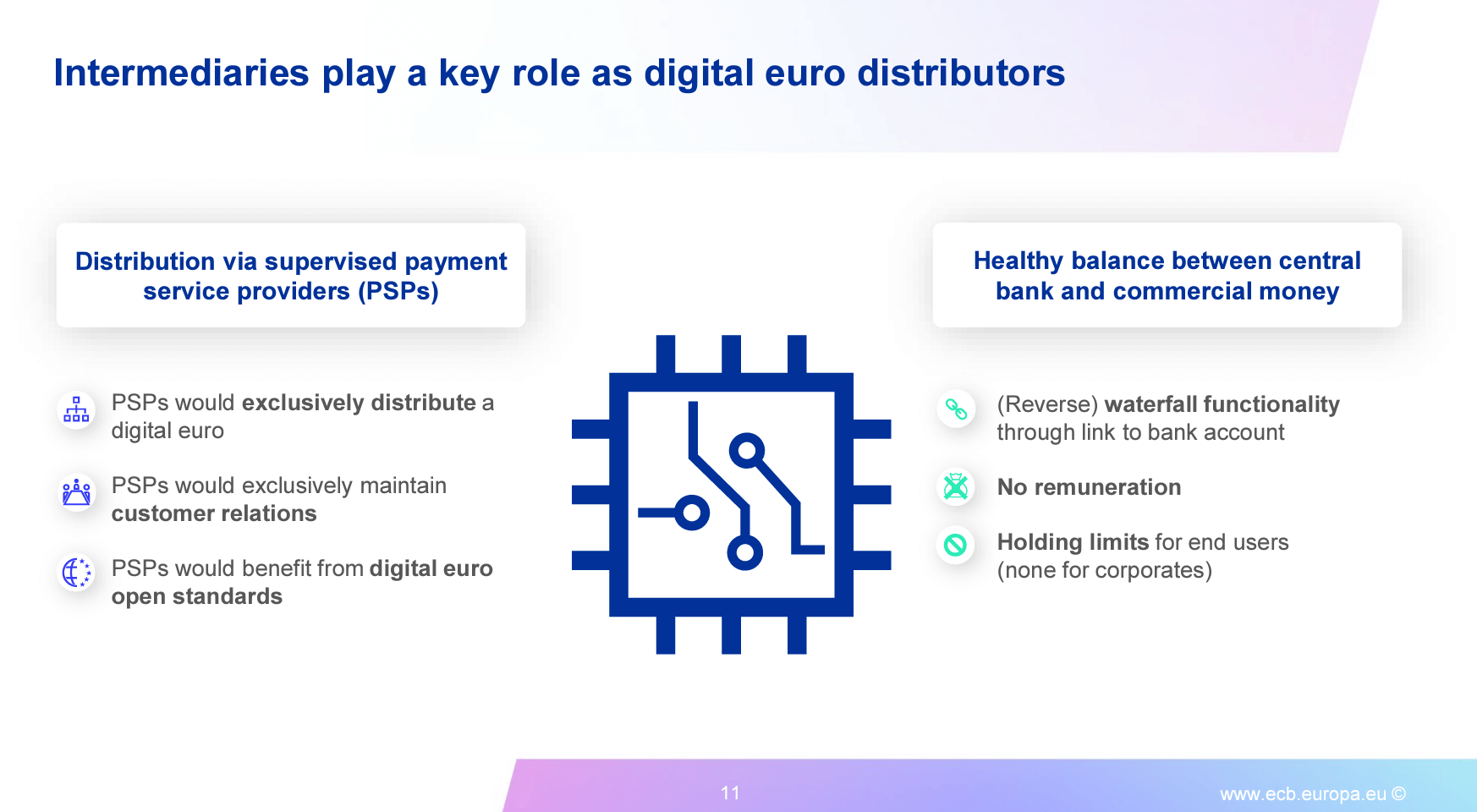

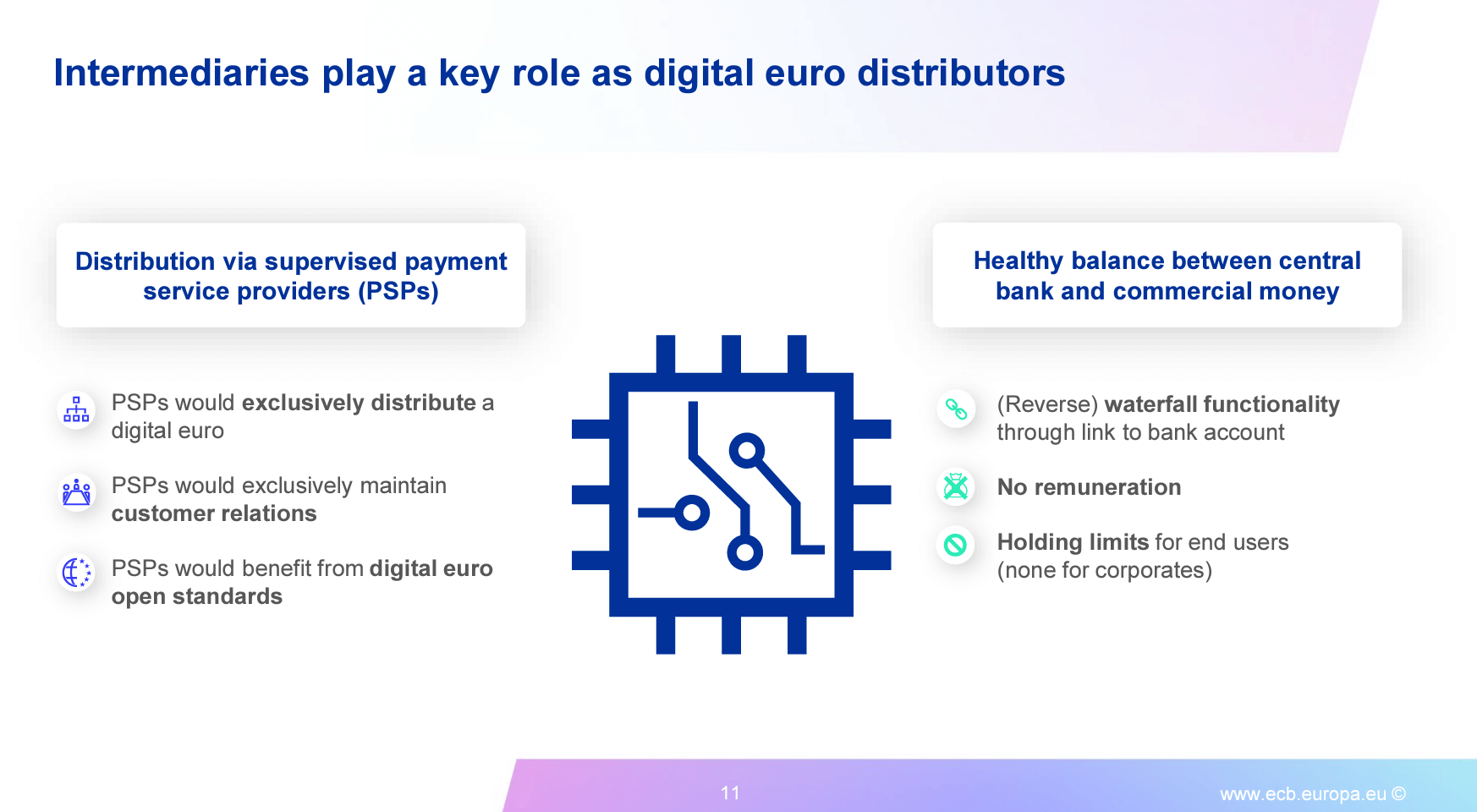

The presentation also claims that the digital euro will be distributed through supervised payment service providers, maintaining a healthy balance between central banks and commercial funds. PSPs can exclusively distribute the digital euro, strengthen customer relationships and benefit from open standards. The Digital Euro Rulebook, drafted with the participation of market participants, will establish common standards to ensure pan-European coverage and a harmonized payment experience, while giving the market the freedom to develop innovative solutions.

In particular, the slide above shows how “retention limits” are applied to end users. However, this does not apply to “corporations”. This suggests that while there is a limit to the amount of digital euros retail users can store, there is no limit to the company. According to the presentation, these features aim to create “a healthy balance between central banks and commercial funds.”

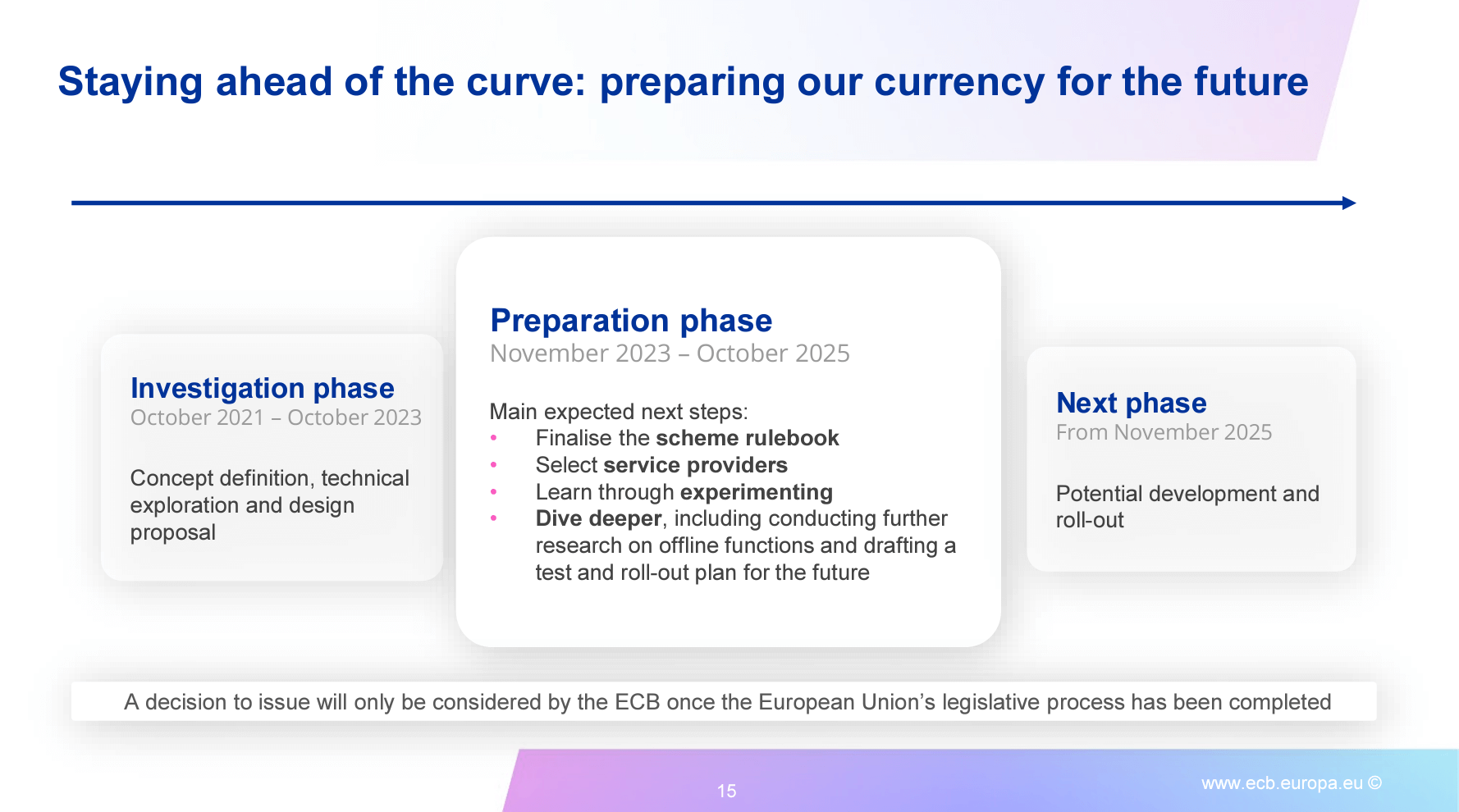

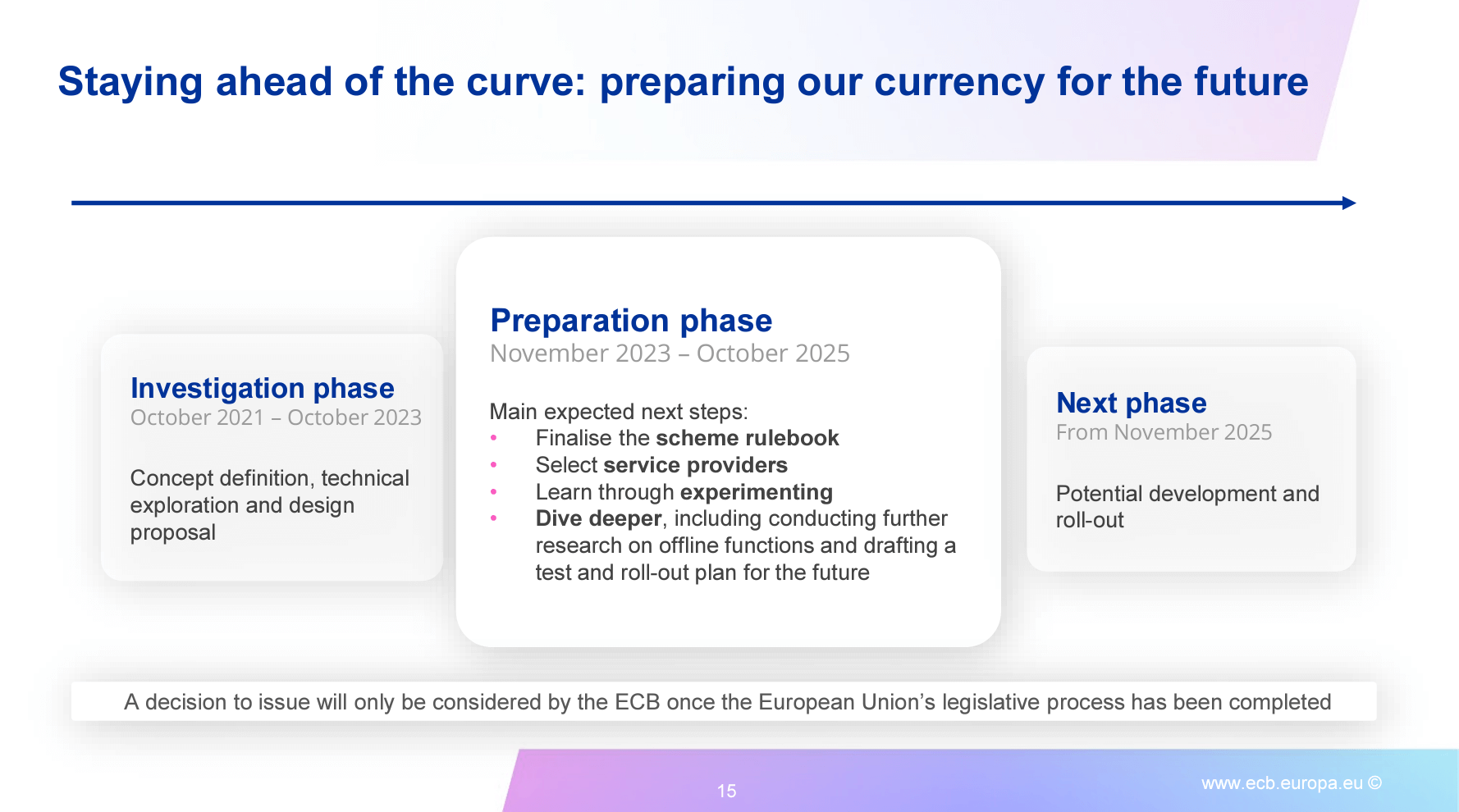

The Digital Euro project has passed an initial research phase (October 2021-October 2023) focused on concept definition, technical exploration and design proposals. The current preparation phase (November 2023 to October 2025) includes finalizing the scheme rulebook, selecting service providers, learning through experimentation, and conducting further research on offline functionality and testing and rollout plans. The decision to issue a digital euro will be considered by the ECB only after the EU’s legislative process has been completed. However, the document states that it could possibly be released in November 2025.

As the ECB moves forward with its plans for a digital euro, the debate surrounding privacy and the potential for surveillance continues. Critics like WalkerAmerica urge individuals to research Bitcoin and move away from what they perceive as a “totalitarian surveillance token.” The ECB must address these concerns and provide explicit guarantees on data protection and user privacy to ensure widespread acceptance of the digital euro.