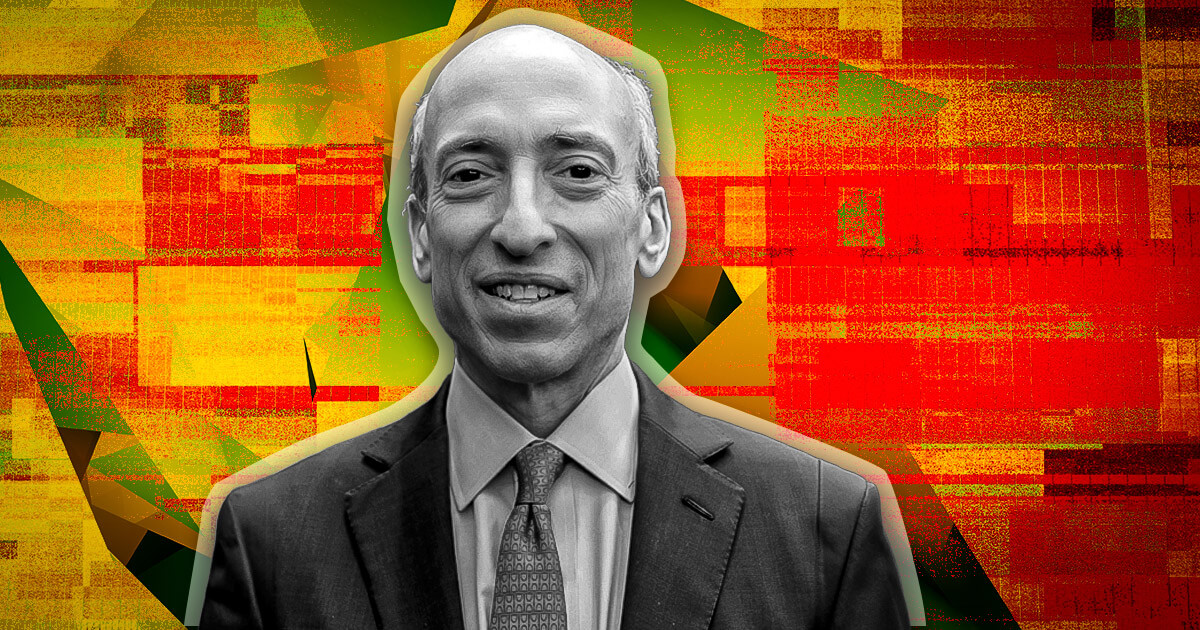

SEC Chairman Gary Gensler warned investors to carefully consider the merits of each project after markets experienced extreme volatility following Bitcoin’s rise to record highs.

Gensler made a statement in an interview with Bloomberg on March 6 and likened the volatility of the cryptocurrency market to a roller coaster ride.

According to the SEC Chairman:

“(Cryptocurrency) is a highly speculative asset class. You can take a look at Bitcoin’s volatility over the past few days. I grew up loving roller coasters. But as an average investor, you have to recognize that this is a bit of a roller coaster ride for a volatile asset.”

Continuing the metaphor, Gensler urged investors to consider the strength of each asset’s fundamentals as it reaches the “top of the hill.” He added that essential considerations include cash flow, use cases, and each asset’s potential status as a security.

Gensler’s comments come after Bitcoin suffered a bloody market rout, briefly reaching an all-time high of $69,324 on March 5 before falling 11% to $60,861 in a matter of hours.

However, major assets and overall markets recovered most of their losses on March 6, with the major cryptocurrency trading at $65,834 at press time.

ETH ETF

When pressed to comment on the possible approval of a spot Ethereum ETF, Gensler said the SEC has the previously filed filings and is reviewing them. He did not mention specific applications.

The SEC must decide whether to approve or reject VanEck’s application for a spot Ethereum ETF by a May 23 deadline, and many expect the regulator to make a decision on other applications at the same time.

One Polymarket prediction market sees the probability of approval in May as 43%, and several experts, including executives at asset management companies, see the probability of approval as close to 50%.

Gensler also declined to comment on whether Ethereum tokens (ETH) are considered securities and whether this will impact the approval of each pending ETF application. But he said there are up to 20,000 cryptocurrency tokens, many of which could be considered securities because investors rely on the efforts of the group of entrepreneurs behind each project.

Gensler is known for his tough stance on cryptocurrencies and his view that most tokens are securities that should be regulated by the SEC. Bitcoin remains the only asset for which he has been confirmed as a commodity by regulators and the chairman.