The cryptocurrency market has experienced significant upheaval, including: Bitcoin It plummeted 14% in just a few hours, wiping out billions of dollars in leverage. This sudden plunge followed a brief moment of glory when Bitcoin hit an all-time high and highlighted the volatile nature of the cryptocurrency environment.

Understand the impact of derivatives trading

Cryptocurrency traders who utilize options and futures contracts to gain exposure to Bitcoin suffered significant losses, with more than $1 billion in leverage evaporating within hours of the market downturn.

Billions of dollars lost on leveraged positions

A sharp decline in the price of Bitcoin, Recently hit an all-time high of $69,200. About 312,500 traders’ positions were liquidated at $63,600, bringing the total liquidation amount in the last 24 hours to a whopping $1.13 billion.

Market reaction to Bitcoin price volatility

The sudden drop in the price of Bitcoin triggered a series of liquidations, mainly affecting traders who had opened long positions in anticipation of the cryptocurrency hitting $70,000. Additionally, part of the market crash occurred as short positions were liquidated as Bitcoin briefly hit new all-time highs.

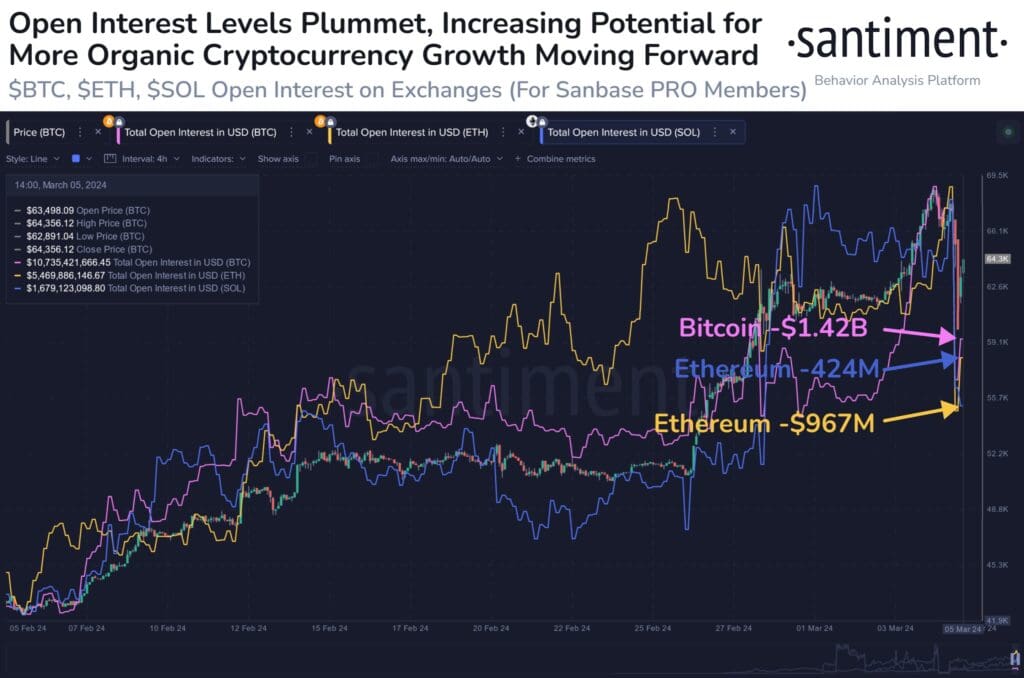

Temporary removal of speculative excess

Santiment, an on-chain analytics provider, attributed the plunge in open interest to the removal of “speculative excess” from the market. Open interest, which measures the total number of open positions in derivatives contracts, has declined significantly after hitting an all-time high for Bitcoin.

Expert insights and analysis

Cryptocurrency analysts have leveraged social media platforms to provide insights into market dynamics. According to one prominent trader, the correction after the all-time high led to the liquidation of a significant number of long positions, resulting in open interest losses of around $3 billion.

Derivatives Flush Normalization

While the flash crash may have rattled some investors, many experts emphasized that derivatives outflows are common in cryptocurrency markets and are usually followed by a period of stabilization and renewed bullish momentum.

Current State of Bitcoin

Bitcoin is currently trading at $63,600, down 8% from its recent all-time high. Despite market volatility, Bitcoin continues to be the focus of investors around the world, with continued speculation about future price movements and market dynamics.