S&P 500: Is there room to run? Despite the most restrictive currency… | By Mosaic Assets | Coins | March 2024

Despite the tightest monetary policy in 20 years, Risky assets such as stocks and cryptocurrencies are charging higher prices..

Last week’s PCE inflation report for January showed a 2.4% year-on-year increase. The trend of easing inflation levels continues It is one of the Federal Reserve’s preferred indicators of inflation.

However, despite progress on the inflation front, investors are rapidly lowering their expectations of interest rate cuts. The first interest rate cut is expected after June.This means that the federal funds rate (red line) will remain well above PCE (blue line) for the foreseeable future. Right now, Spread between federal funds and PCE is highest since 2007 As you can see in the chart below.

However, despite monetary restrictions Low volatility in other areas of the capital markets is weakening overall financial conditions.. For example, the CBOE Volatility Index (VIX) is Implied volatility for the S&P 500 has remained extremely low since November.. at the same time, Interest rate spreads on high yield bonds are near historic lows. (Chart below), indicating conditions under which loans are easy to obtain even for low-quality companies.

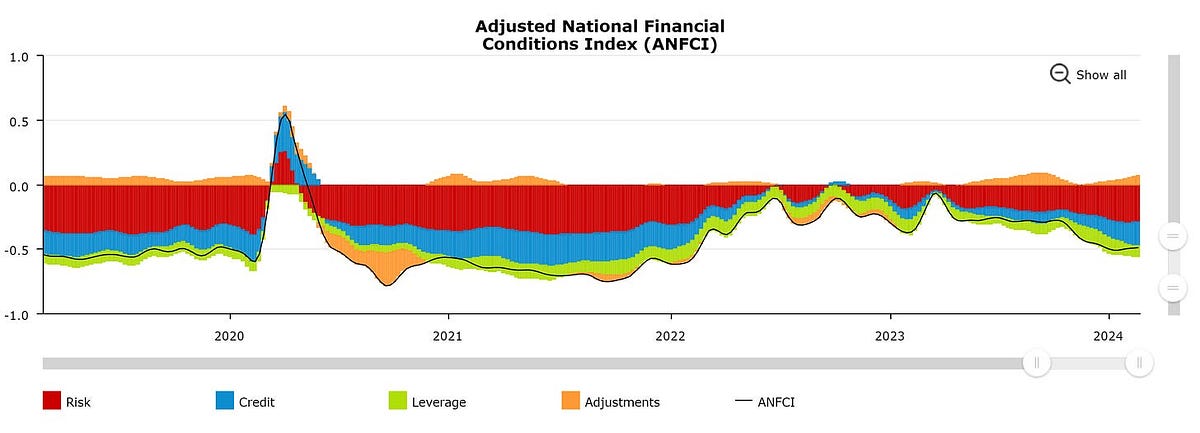

So, despite the level of federal funding, Overall financial conditions remain close to their loosest levels in at least two years. As you can see in the Chicago Kite chart below (a higher value than 0 means conditions are more tense than average and vice versa). And these loose conditions are helping push the S&P 500 to new highs. After adding another 5.2% in February, the index is now up 7.7% for the year..

but Loose conditions aren’t just boosting the S&P 500, they’re igniting other sectors of the capital markets as well. Recently. And this is something that will have a significant impact on the next moves in the stock market.

Despite the difficulties caused by monetary restrictions, Loose financial conditions help further fuel speculative growth areas in capital markets..

Bearish investors point to excessive risk-taking as another sign of frothy sentiment, but a significant fundamental breakout is underway… The new upward trend is still in its early stages. In my opinion, it’s a contrast to announcing the top.

And looking back historically, The new period of strong speculative growth performance represents the best trading environment in over a decade..

The rise of Bitcoin and other cryptocurrencies has captured most of the attention over the past week. After the 50-day moving average is slightly undercut (MA — arrow on the black line in the chart below) Bitcoin had a big rally in February, rising 23% in the past week alone.. The cryptocurrency is currently trading just below its previous all-time high, near the $70,000 level.

But it wasn’t just cryptocurrencies that moved last week. I’ve written about small-cap stocks recently. There are growing signs that small-cap stocks could emerge from a bottoming base, clearing resistance that has persisted into early 2022.. This includes the IWO Small-Cap Growth Exchange Traded Fund (ETF). In the chart below, we can see that IWO broke above the key $260 level last week.

Smaller growth companies tend to be more speculative because most of their profit potential lies in the future. This makes their valuation particularly sensitive to interest rate increases. (Higher interest rates make future profits less valuable in today’s terms). With short-term and long-term interest rates on the yield curve remaining relatively high, the rally in small growth stocks is notable. At the same time, it also highlights the impact of easing overall financial conditions.

Pressure from high interest rates is also highlighting the movement of biotechnology stocks. The XBI Biotechnology ETF also includes many companies whose profits may exist in the future. but XBI broke the $95 level last week, confirming a new upward trend..

I would also like to highlight the recent breakthrough of ETFs tracking retail stocks via XRT. The fund holds companies such as Abercrombie & Fitch (ANF) and Carvana (CVNA). Given the importance of a strong economy and consumer spending to sales and profits, the departure from the bottom hit two years ago is notable. also.

Since early September, I’ve been showing you how. The right sectors were leading the stock market, pushing the S&P 500 to new record highs.. At the time, it was industries such as housing construction and semiconductor stocks. The next round of fundamental breakouts for ETFs tracking sectors such as small-cap growth and biotechnology indicate that risk-taking sentiment continues to improve..

The S&P 500 is off to a hot start to 2024, hitting new highs. The rally may still be in its early stages. This is especially true when more than a year has passed since the S&P hit an all-time high, indicating a consolidation phase for the index.

The S&P has been in a bear market since it last hit a high in early 2022, two years after hitting an all-time high. The chart below is as follows: The S&P’s average forward increase rate when hitting a new high in over a year, and after 12 months, the index rises by about 15% on average..

It’s also worth considering that the average bull market in the S&P 500 has lasted an average of 694 days since 1940. The current bull market has lasted 506 days. With small-cap growth and new upswing in sectors like biotechnology, I think there’s still room to run..

I also continue to believe that the sustainability of the rally will come down to the earnings picture, given the need for a sustained recovery to support the stock price. Estimates of future earnings for the S&P 500 hit record highs before prices rose. and now The rate of change in small-cap profits also increased for the first time in a year. As you can see below.

By improving risk psychology We are paying more attention to small-cap growth stocks with solid performance and sales profiles that are forming favorable chart patterns.. This includes several Brazilian fintech companies, such as Inter (INTR).

Year-over-year revenue growth has been more than 40% for the past three quarters, and revenue growth for the most recent quarter was 400% (although this isn’t an easier comparison). The stock has been based just below its previous high since November, near the $6 level. Now I expect the MACD to break out to new highs while rising from the zero line.

That’s all for this week. The macro calendar will get even heavier in the week ahead, with Federal Reserve Chairman Jerome Powell speaking to Congress and the February employment report released on Friday. However, as more sectors see fundamental breakouts, we will watch for positive follow-through and a positive impact on market breadth..

We hope you enjoyed The Market mosaic. Please share this report with your family, friends, colleagues, and anyone else who could benefit from an objective look at the stock market.

Visit here for updated charts, market analysis and other trading ideas. www.mosacassetco.com

Disclaimer: This is not a recommendation, just my thoughts and opinions. Do your own due diligence! I may have a position in the securities mentioned in this report.