Ethereum (ETH) is struggling to maintain $3500, with analysts warning of a possible near-term correction.

Posted: March 1, 2024 8:33 AM Updated: March 1, 2024 8:33 AM

Correction and fact check date: March 1, 2024, 8:33 AM

briefly

The price of Ethereum (ETH) recently peaked at $3,515 and then fell to $3,219, and analysts are predicting the possibility of a short-term correction.

Ethereum (ETH) price recently reached the expected level of $3,500. This figure was last recorded in 2021, with Bitcoin reaching $64,000, its highest in 27 months. Upcoming Dencun upgrades. However, despite this performance, there was a noticeable increase in bullish leveraged positions and bearish on-chain indicators, suggesting a possible near-term correction for the cryptocurrency.

Over the past 24 hours, the cryptocurrency market has seen a significant increase in liquidations, with total liquidations exceeding $750 million. However, Ethereum has experienced total liquidations worth about $120 million in the last 24 hours, with sellers liquidating positions worth about $70 million.

The recent upward move in ETH price towards $3,515 was accompanied by a surge in the cost of bullish leveraged positions, raising concerns. With ETH briefly falling to $3,219 this morning, some investors believe overly optimistic sentiment has raised the risk of widespread liquidation amid fears of losses.

Moreover, price volatility near $3,500 led to the liquidation of $102 million worth of ETH, of which $66 million were long positions. This situation increased the leverage of existing bullish positions as ETH price fell to $3,200, reducing margins. Ethereum’s current funding rate is 0.067%, which equates to 5.6% monthly and is noticeably higher than the baseline over the past few weeks. This suggests that sustainability may not be possible over a long period of time.

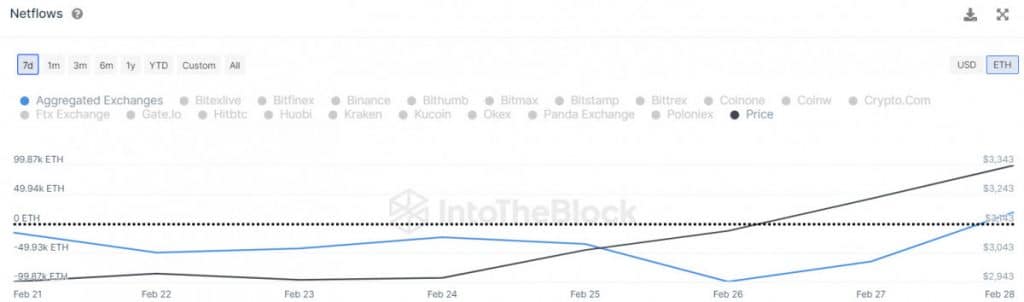

Additionally, with prices hovering near the highs of $3,300-$3,500, downward price pressure is increasing, with short-term holders increasingly exiting the market. The Netflow indicator recently crossed its signal line and is currently in positive territory, indicating that the amount of ETH flowing into exchanges is exceeding the amount going out, leading to an increase in exchange reserves. This trend could increase selling pressure, potentially triggering another correction in ETH price.

Ethereum price moves further

Facing resistance at the $3,500 level, ETH is expected to undergo a price correction and sellers will become active at higher levels. Nonetheless, buyers show resilience around this threshold. According to data from CoinMarketCap, the current price of ETH is $3,431, up slightly by 1.1% compared to yesterday’s valuation.

Despite the weak decline, the bright side is that the price remains above the 20-day exponential moving average (EMA) of $3,281, providing a glimmer of optimism. However, if the price fails to break above the $3,500 level in the near future, selling pressure is likely to increase. A decline below the 20-day EMA could lead to a decline towards the upward support at $3,000.

Ethereum’s recent rise to $3,500 has increased optimism, but analysis suggests the cryptocurrency could potentially witness a correction, prompting investors to exercise caution.

disclaimer

In accordance with the Trust Project Guidelines, the information provided on these pages is not intended and should not be construed as legal, tax, investment, financial or any other form of advice. It is important to invest only what you can afford to lose and, when in doubt, seek independent financial advice. Please refer to the Terms of Use as well as the help and support pages provided by the publisher or advertiser for more information. Although MetaversePost is committed to accurate and unbiased reporting, market conditions may change without notice.

About the author

Alisa is a reporter for Metaverse Post. She focuses on everything related to investing, AI, metaverse, and Web3. Alisa holds a degree in Art Business and her expertise lies in the fields of art and technology. She developed a passion for journalism through her work with VCs, notable cryptocurrency projects, and science writing. You can contact us at (email protected).

more articles

alice davidson

Alisa is a reporter for Metaverse Post. She focuses on everything related to investing, AI, metaverse, and Web3. Alisa holds a degree in Art Business and her expertise lies in the fields of art and technology. She developed a passion for journalism through her work with VCs, notable cryptocurrency projects, and science writing. You can contact us at (email protected).