Welcome to the February CryptoSlate Alpha Monthly Snapshot, an exclusive digest designed for CryptoSlate Alpha subscribers.

In February, our comprehensive reports and insightful articles delved deep into the cryptocurrency ecosystem, providing a mix of market analysis, research insights, and forward-thinking trends that could shape the future of finance and technology.

The February Alpha Markets report includes a critical analysis of credit spreads and their significance to cryptocurrency markets, along with an in-depth look at the economic impact of the Federal Reserve’s Reverse Repo (RRP) regime and its potential ramifications for Bitcoin.

It also explored why governments should prefer regulating stablecoins over developing central bank digital currencies (CBDCs), providing a nuanced perspective on digital currency governance.

The research article highlighted record economic investment in Bitcoin, analyzed Bitcoin market behavior before the storm, and presented unprecedented stability in Bitcoin futures and options open interest.

In particular, our insights pointed to the important role of US exchanges in providing liquidity to the Bitcoin market and the trend toward longer-term holdings as exchange balances fell to their lowest levels since 2018.

Our top Alpha Insights provided a comprehensive view of the cryptocurrency landscape, from the impact of HODL waves and on-chain indicators that hint at speculative markets and potential network health deterioration, to the significant impact of near-term trading volume and institutional participation.

We analyzed the actual cost of mining one Bitcoin, examined the speculative and resilient nature of Bitcoin investors, and detailed Bitcoin’s trading patterns, supply distribution, and how ETFs impact market dynamics. Provided detailed analysis.

Join us as we unravel these topics as we provide Alpha subscribers with a wealth of data-driven analysis and expert commentary on the evolving cryptocurrency space.

February α Market Report

Economic Impact of the Federal Reserve’s Reverse Repo (RRP) System

CryptoSlate explores the complexities of RRP facilities, their impact on traditional financial markets, and their potential impact on Bitcoin.

What is a credit spread, why is it narrow, and what does it mean for Bitcoin?

CryptoSlate takes a closer look at the concept of credit spreads and analyzes its current state to understand its impact on the broader financial and cryptocurrency markets, and Bitcoin in particular.

Why governments should regulate stablecoins instead of developing CBDCs

CryptoSlate examines the benefits of regulating stablecoins, exploring why they serve both the private and public interests better than CBDCs.

February α Research Paper

The record high realization limit shows unprecedented economic investment in Bitcoin.

The Bitcoin network and its participants have never been more economically invested in BTC than they are now.

The Bitcoin market is facing a moment of crisis amid a surge in unrealized profits.

Spot ETF inflows and bullish sentiment are pushing Bitcoin higher despite potential volatility due to unrealized gains.

Bitcoin surged to $57,000, but no liquidation storm occurred, defying the expected trend.

Despite Bitcoin’s strong rally, liquidations are still in effect, indicating that the market is cautious.

Bitcoin futures and options open interest surged in February.

Despite the near-term rise in defensive puts, Bitcoin options are leaning towards a bullish outlook.

Bitcoin network congestion was alleviated with the cleanup of the mempool in February.

Bitcoin’s mempool was unblocked in February, bringing a breath of fresh air to transaction processing.

How do US exchanges contribute to Bitcoin market liquidity?

Although U.S. exchanges account for a relatively small portion of global trading volume, they provide 49% of global liquidity. This means greater market depth to facilitate large trades for a small number of traders.

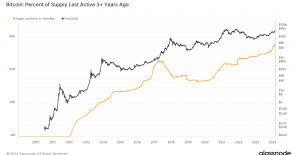

Bitcoin exchange balances fell to their lowest level since 2018 as the market shifted to HODLing.

Bitcoin holders are moving away from exchanges due to the long-term holding trend.

The increase in stablecoin supply shows capital inflow into the cryptocurrency market.

The rise in stablecoin market capitalization signals increased capital flows into cryptocurrencies and investor readiness for market movements.

On-chain data shows that Bitcoin supply is tightening.

Unspent transaction output and cumulative trends indicate that Bitcoin supply is strengthening amid rising institutional interest.

Futures open interest hit a two-year high with Bitcoin surpassing $50,000.

The record high in Bitcoin futures open interest coincides with a price breakout.

As Sharpe Signal Soars, Bitcoin’s Risk-Adjusted Return Potential Soars.

A new indicator from Glassnode shows a promising rebound in Bitcoin market sentiment.

Why did Bitcoin’s market capitalization soar by over $102 billion while its realized capitalization only increased by $4 billion?

Although Bitcoin’s market capitalization is growing rapidly, Bitcoin’s realized capitalization provides a more grounded view of its value.

Bitcoin above $44,000 spurs market confidence as surge in unrealized gains.

As market sentiment improves, profitability soars among Bitcoin investors.

What Bitcoin Trading Patterns on Centralized Exchanges Tell Us About the Market

CryptoSlate’s analysis of Kaiko data shows that the majority of global Bitcoin transactions occur on Binance outside the United States.

Bitcoin options show long-term bullishness and short-term pessimism.

Bitcoin options data shows an optimistic outlook for the future amid current market hesitation.

How have ETFs affected the distribution of Bitcoin supply across cohorts?

Spot Bitcoin ETFs have created a significant change in the Bitcoin supply distribution.

Short-term trading volume reached a peak as Bitcoin passed $43,000.

Bitcoin’s SLRV ratio shows that spot Bitcoin ETFs have most likely fueled the unprecedented near-term trading volume.

Whales and institutions are driving Bitcoin trading volume surge.

Glassnode data shows that whales and institutions are the main actors in the growth of Bitcoin trading volume.

Here are some reasons why the Bitcoin perpetual futures market showed high volatility in January:

January will see traders re-evaluating Bitcoin perpetual futures among emerging ETF options.

Marathon vs. Riot: Analysis of the Real Cost of Mining 1 Bitcoin

We estimate the actual average cost of mining a single Bitcoin from two of the largest publicly traded Bitcoin mining companies.

February’s Top α Insights

HODL wave analysis shows that a speculative market is at work.

Bitcoin’s journey from $25,000 to $50,000, not marked by extreme short-term speculation.

On-chain indicators provide insight into the state of the Bitcoin network, suggesting a potential decline.

Monthly and annual metrics for Bitcoin on-chain activity show network health and utilization trends, highlighting potential declines.

Bitcoin’s STH realized price is approaching $40,000, signaling strong market momentum.

Analysis of Bitcoin dynamics: STH has realized the role of price in current market trends.

US leads Bitcoin price surge amid Asian decline

The United States takes a bullish stance and leads the way with a whopping 12,200% price change.

Analysis Challenges Bitcoin Returns Theory Amid Recent Uptrend.

Bitcoin’s current cycle is challenging the theory of diminishing returns, with an increase of approximately 287% from the low.

Bitcoin investors demonstrated long-term holding resilience in 2021.

Starting in 2021, Bitcoin investors will lower their cost base through strategic purchases during bear markets.

After spending 153 days in the $40,000-$45,000 range, Bitcoin is targeting its sixth monthly close above $50,000.

Bitcoin exploring above $50,000 suggests continued consolidation after breaking a long-term range.

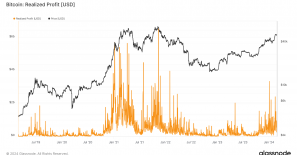

Short-term holders sent a record $3 billion in profits to the exchange.

The success of the spot ETF pushes Bitcoin above $58,000, demonstrating investor confidence.

Bitcoin investor realizes net profit for 128 consecutive days

Despite Bitcoin’s solid performance, the intensity of profit taking in 2024 cannot match the excitement of the 2021 bull market.

From Record Highs to Remarkable Lows: Bitcoin Fees After the Epitaph Boom

Bitcoin fees have hit a new low, and miners are seeing their fee-based profits stabilizing at 6%.

The post From Credit Spreads to HODLing Patterns: Exploring Crypto Market Changes in February appeared first on CryptoSlate.