Bitcoin ETF: How Demand Affects Price (Brief Explained) | Posted by Vamshi Vangapally | Coins | February 2024

Understand how Bitcoin ETFs work and what happens when demand increases or decreases.

Bitcoin ETFs are a hot topic, but what effect will they actually have on the Bitcoin price? I will explain it in an easy-to-understand manner even for those who are new to investing. We’ll take a look at supply, demand, and why the treasure chest of Bitcoin ETFs matters.

Approval Schedule

- Bitcoin Futures ETF: The Securities and Exchange Commission (SEC) approved a Bitcoin futures ETF in October 2021. The fund invests in Bitcoin futures contracts. A Bitcoin futures contract is a contract to buy or sell Bitcoin at a predetermined future price and date.

- Spot Bitcoin ETF: After years of rejections and discussions, the SEC finally approved the first spot Bitcoin ETF in January 2024. It tracks the price of Bitcoin directly, giving investors a more direct way to gain exposure to the cryptocurrency.

Advantages of Bitcoin ETF

- accessibility: Bitcoin ETFs allow investors to gain exposure to Bitcoin through a traditional brokerage account, making the investment process easier.

- regulation: ETFs are regulated by the SEC and potentially offer some level of investor protection compared to purchasing Bitcoin directly on a less regulated cryptocurrency exchange.

- diversification: Investors can add the Bitcoin ETF to their portfolio for diversity and broad exposure to the cryptocurrency market.

Things to keep in mind

- volatility: Bitcoin is a highly volatile asset, so its price can fluctuate significantly. This volatility is also reflected in Bitcoin ETFs.

- research: It is important to research different Bitcoin ETFs, their fees, and their performance before investing.

- Investment Goals: Always consider your investment objectives and risk tolerance before investing in a Bitcoin ETF.

totally! Let’s break down how a Bitcoin ETF works in a simple way.

Imagine a treasure chest

Think of the Bitcoin ETF like a special treasure chest. Instead of holding gold or jewelry, these boxes are designed to track the value of bitcoins.

Two types of treasure chests

- Gift Treasure Chest: This box does not contain actual Bitcoins. Instead, there is little commitment: “I promise to buy or sell Bitcoin at a certain price in the future.” This is like betting on what the price of Bitcoin will be.

- Spot Treasure Chest: This is simpler: It’s actually like a treasure chest with actual bitcoins inside. The value of these boxes rises and falls depending on the actual price of Bitcoin.

How it applies to you

As an investor, you are not buying a whole treasure trove. Instead of:

- You buy stocks: You buy small pieces of the treasure chest, called stocks. These stocks are traded on regular stock exchanges, just like you would buy shares of a company like Apple or Google.

- What a fund manager does: There are experts who manage treasure chests. These are the people who either buy the actual Bitcoin (for spot ETFs) or manage the commitments (for futures ETFs).

Why This Matters

- Investing Easier: ETFs make it easier to participate in Bitcoin without having to purchase and store the cryptocurrency yourself.

- Familiar purchasing methods: You can purchase ETF shares using your regular stock trading account.

Remember:

- Bitcoin is dangerous: The price of Bitcoin can fluctuate much more than some stocks. Therefore, the value of the ETF shares will change accordingly.

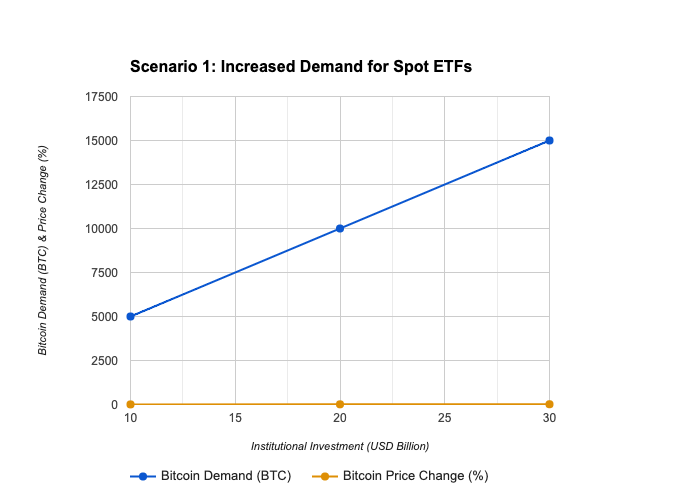

Let’s take a look at how increased demand for Bitcoin spot ETFs will impact the overall Bitcoin market along with potential downside scenarios.

Bullish scenario (when demand increases)

- Increased demand: If large funds decide to invest in Bitcoin spot ETFs, demand for physical Bitcoin will increase. They need to buy Bitcoin to fill the “treasure chest” we talked about earlier. Increased demand usually leads to an increase in the price of Bitcoin.

- Supply is squeezed: Bitcoin has a limited supply (there are only 21 million coins). If more people want to buy, but supply does not increase at the same rate, a supply shortage will occur, causing prices to rise further.

- More institutional adoption: This is a sign of widespread acceptance of Bitcoin as a legitimate asset class by the biggest names in the investment world. This could attract more investors to Bitcoin.

Bearish scenario (why demand is falling)

- regulation: Some investors may be scared if stricter regulations are implemented, especially for cryptocurrencies or Bitcoin ETFs.

- Bitcoin price collapse: If the price of Bitcoin itself falls sharply and for an extended period of time, this could reduce the appetite of asset funds and retirement funds to invest in ETFs.

- Better alternatives: Investors may turn their attention away from Bitcoin ETFs when other investment options with similar risk profiles but higher potential returns become available.

- Loss of confidence: A major security breach or Bitcoin-related scandal in the cryptocurrency space could damage confidence in the overall market and reduce demand for ETFs.

Important note: It is important to remember that the cryptocurrency market is very dynamic. The future of Bitcoin ETFs and their impact on the Bitcoin price will depend on several factors, including regulation, market sentiment, and overall developments in the cryptocurrency space.

As demand for spot ETFs decreases, fund managers will likely start selling some of their Bitcoin holdings. Here’s why:

- Maintain ETF Value: The main goal of a Spot Bitcoin ETF is to track the Bitcoin price as closely as possible. When investors sell ETF shares, the fund must sell some Bitcoin to reflect reduced demand and keep the ETF price in line with the falling Bitcoin value.

- Readjust: If a fund manager starts holding too much Bitcoin compared to other assets in the fund, he or she may sell Bitcoin to rebalance the portfolio.

Price Discovery: Increasing Demand vs. decrease

Price discovery is the process by which the market determines a fair price for an asset based on the ever-changing balance of supply and demand. Here’s how it works in the context of Bitcoin and spot ETFs:

Increased demand:

- More Buyers: As more investors want to buy Bitcoin spot ETFs, demand for Bitcoin increases.

- Limited supply: Bitcoin has a fixed supply and a limited number of new Bitcoins are created over time.

- Price goes up: As more people want to buy and supply becomes limited, buyers are willing to pay higher prices to buy Bitcoin. This causes the price of Bitcoin to rise.

Reduced demand:

- More sellers: As investors lose interest in Bitcoin spot ETFs, demand decreases. ETF managers may need to sell some of their Bitcoin holdings.

- Increased supply (relatively): ETF sales make some Bitcoin available, increasing the relative supply in the market.

- Price drop: As demand decreases and more Bitcoin becomes available, sellers may have to accept lower prices to find buyers. This causes the price of Bitcoin to fall.

Important considerations:

- Market Sentiment: Price discovery isn’t just about ETF demand. General investor sentiment towards Bitcoin and the overall cryptocurrency market plays a big role.

- Other exchanges: Bitcoin is traded on numerous exchanges. The activity of the exchange also has a significant impact on the price discovery process.

Bitcoin ETFs offer a new way to gain exposure to Bitcoin through the familiar world of stocks and funds. It is important to remember that, like any other investment, Bitcoin ETFs involve risk. Bitcoin prices can be highly volatile, so please thoroughly research and understand these risks before investing. If you are considering a Bitcoin ETF, consider it as part of a well-diversified portfolio that aligns with your overall investment goals.

This information is provided for educational purposes only and should not be considered financial advice. Cryptocurrency markets are complex and involve significant risk. Always conduct your own research and consult with a financial advisor before making any investment decisions.