Ethereum Price Prediction: ETH Violates $3K Again on Dencun Upgrade, Ether ETF Optimism As Time Is Running Out to Buy This Soaring ICO

join us telegram A channel to stay up to date on breaking news coverage

The price of Ethereum has risen nearly 2% over the past 24 hours, trading at $3,065 as of 5:30 a.m. ET, with volume up 10%.

ETH’s recent breakout of the $3,000 psychological level came amid optimism on two topics. First, following the approval of the spot Bitcoin exchange-traded fund (ETF) in January, we are expecting the approval of the Ether ETF as early as May.

🚀🔥 Ethereum FOMO has reached new heights! The staking and re-staking narrative piques investor interest with over 31 million ETH staked. Approval of a spot ETH ETF could amplify the supply shortage, pushing ETH to new highs. #ETH #FOMOrising

— Wash (@shoybis) February 26, 2024

As expectations for the ETH ETF grow, FOMO (fear of missing out) is also driving investors. Staking and re-staking stories continue to drive demand for Ethereum. A potential spot ETH ETF approval could also reduce market supply, which explains the current heightened bullish sentiment.

Another driver for the Ether market is the Dencun upgrade, which went live on the Goerli testnet on January 17 to introduce several Ethereum Improvement Proposals (EIPs). This includes EIP-4844, which allows for Proto-dank sharding with the ability to reduce transaction fees in Layer 2 (L2) space. The Dencun upgrade completed Phase 3 of testing, launching on the Holesky testnet on February 7.

With the potential to come $ETH May ETF, Ethereum’s Decun Upgrade on March 13th, ETH’s Strong Q1 History and Outstanding Post Halving Performance, with Expected Rate Cuts in May/June

I plan to buy some more #Ethereum ASAP.

But I still stick to my ichimoku… pic.twitter.com/cFcETrtDAG— Jack Green 💹 (@JackGreenCrypto) February 26, 2024

In an announcement on February 8, Ethereum developer Tim Beiko revealed that the Dencun upgrade would be released on mainnet in “slot 8626176.” Blockchain research firm Nethermind added that this will happen on March 13, 2024 at approximately 13:55:35 UTC.

According to a recent announcement from blockchain research firm Nethermind, #EthereumThe Dencun upgrade is scheduled to be released on March 13, 2024 at 13:55:35 UTC. This upgrade combined with the potential #ETH Spot ETF approval and #Bitcoin It could lead to the April halving…

— Gutarius (@gutarius) February 16, 2024

Due to optimism about the ETH ETF and the Dencun upgrade leading the Ether market, the Ethereum price remains bullish overall, with several headlines highlighting its outperformance of Bitcoin. The overall ETH market sentiment is distinctly bullish.

Cryptocurrency Bull Run Opportunity

Cryptocurrency Senti Score: 8.0

Summary: Total Market #emotion It is clearly optimistic and mainly centers around: #Bitcoin and #EthereumThere is potential for significant growth due to technical patterns, ETF approvals, the upcoming halving, etc. pic.twitter.com/6HubprR1NF

— Finsenty (@finsentyapp) February 26, 2024

Exaggerated Ethereum Price Predictions on Dencun Upgrade and Potential ETH ETF

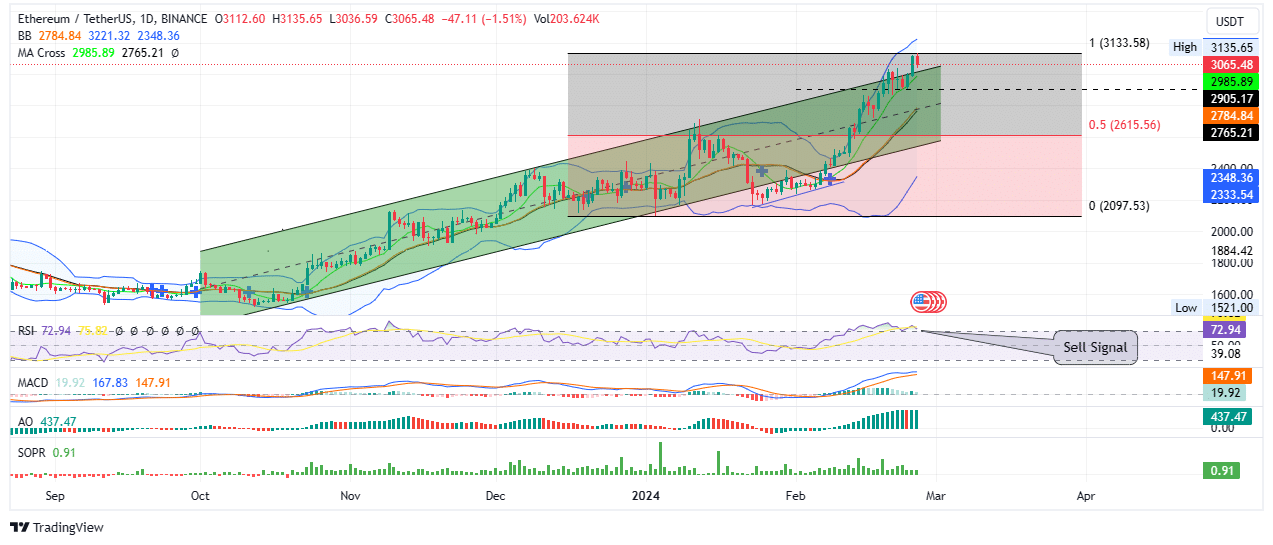

The massive optimism pushed the Ethereum price above the upper limit of the ascending parallel channel to a high of $3,135. However, traders are already taking profits, as indicated by the red Japanese candle on the ETH/USDT daily chart below. There is also an activated sell signal on the chart when the Relative Strength Index (RSI) crosses below the signal line (yellow band). According to technical analysis expert Welles Wilder, while ETH is overbought with RSI above 70, Proof-of-Stake (PoS) tokens are ripe for selling if RSI falls below 70.

However, in the meantime, the market is still favoring the bulls and the bulls remain in a strong position in the ETH market. This can be seen in the large number of green histogram bars on the Awesome Oscillator (AO) indicator.

The Moving Average Convergence Divergence (MACD) indicator also remains above the signal line (orange band), with the histogram bar still in positive territory. This reinforces the bullish outlook seen in the Ethereum price.

Strengthening buyer momentum could push Ethereum price past the highs of the $3,135 range and create new local highs. If the bulls have their way, ETH’s targets include a $3,500 milestone or, if we’re very bullish, likely reaching the psychological $4,000 level. Such a move would represent a 30% increase from current levels.

TradingView: ETH/USDT 1-day chart

converse case

On the other hand, if the downtrend goes its way, the price of Ethereum could fall below $3,000 and fall into the limits of the channel. ETH’s downtrend could be extended if the support at $2,905, where the price has been holding since February 19, is broken.

A prolonged decline could see Ethereum price testing the channel midline, which joins the central line of the Bollinger indicator and its long-term moving average at $2,985. In a worst-case scenario, ETH could decline further towards the 50% Fibonacci retracement level of $2,615, below which the bullish assumptions would be invalidated.

Meanwhile, investors are increasingly paying attention to Sponge V2 due to expectations of Dencun upgrades and prospects for the ETH ETF. This token is rated as one of the best penny cryptocurrency investments with explosive growth potential.

The token comes on the scene after the exponential profits recorded by its predecessor, Sponge V1, which thrived with 100x profits in 2023. Can Sponge V2 achieve the same success? This video has some answers:

A promising alternative to Ethereum

One of the best cryptocurrency ICOs of 2024, Sponge V2 is one of the latest meme coin sensations that builds on the success of its predecessor, Sponge V1. The frontrunner made headlines in the May 2023 season, earning 100x its return since its launch. Now, both investors and analysts are expecting better performance from the new upgraded version.

Taking over the baton from Sponge V1, Sponge V2 offers better features and increased value to token holders. Among them is staking, which offers the opportunity to earn passive rewards.

Interesting news, #Sponger! 🌟🧽🧽#SpongeV2 It’s live now! To purchase and stake, visit our website. $sponge V2.

Check it out below! 👇https://t.co/nFOSl1ZCD9#memecoin #web3 #Cryptocurrency #altcoin #Crypto Staking pic.twitter.com/T4DCAKhcxF

— $SPONGE (@spongeoneth) February 6, 2024

According to Youtube analyst Alessandro De Crypto, Sponge V2 will be the next meme coin star, following Dogecoin (DOGE), Bonk (BONK), and Pepe (PEPE).

Hello $BONK…

We will come for you 🤫#bonk #Sponge V2 #sponge #pepe #memecoin #Cryptocurrency #how pic.twitter.com/ZjLYW0MLR3

— $SPONGE (@spongeoneth) January 25, 2024

Sponge V2 introduces stake-bridge, a unique token distribution method where users stake old tokens for new versions. The staking feature has received tremendous support with over 8.636 billion tokens already staked. Holders enjoy impressive Annual Percentage Yields (APY) of over 187% on Ethereum and 815% on Polygon.

New entrants to the Sponge V2 ecosystem can earn tokens through the website using ETH, USDT, or credit cards.

If you do not yet own SPONGE V1, you will need to purchase the V1 version. These holdings can then be put into bridging contracts.

To find out more and purchase Sponge V2, visit their website here.

Also read:

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 50% or more

join us telegram A channel to stay up to date on breaking news coverage