Bitcoin’s mempool is a storage area for transactions that are broadcast to the network but have not yet been included in a block. Analyzing mempools provides insight into network congestion, transaction demand, and fee trends, providing a unique vantage point on the state of the Bitcoin ecosystem.

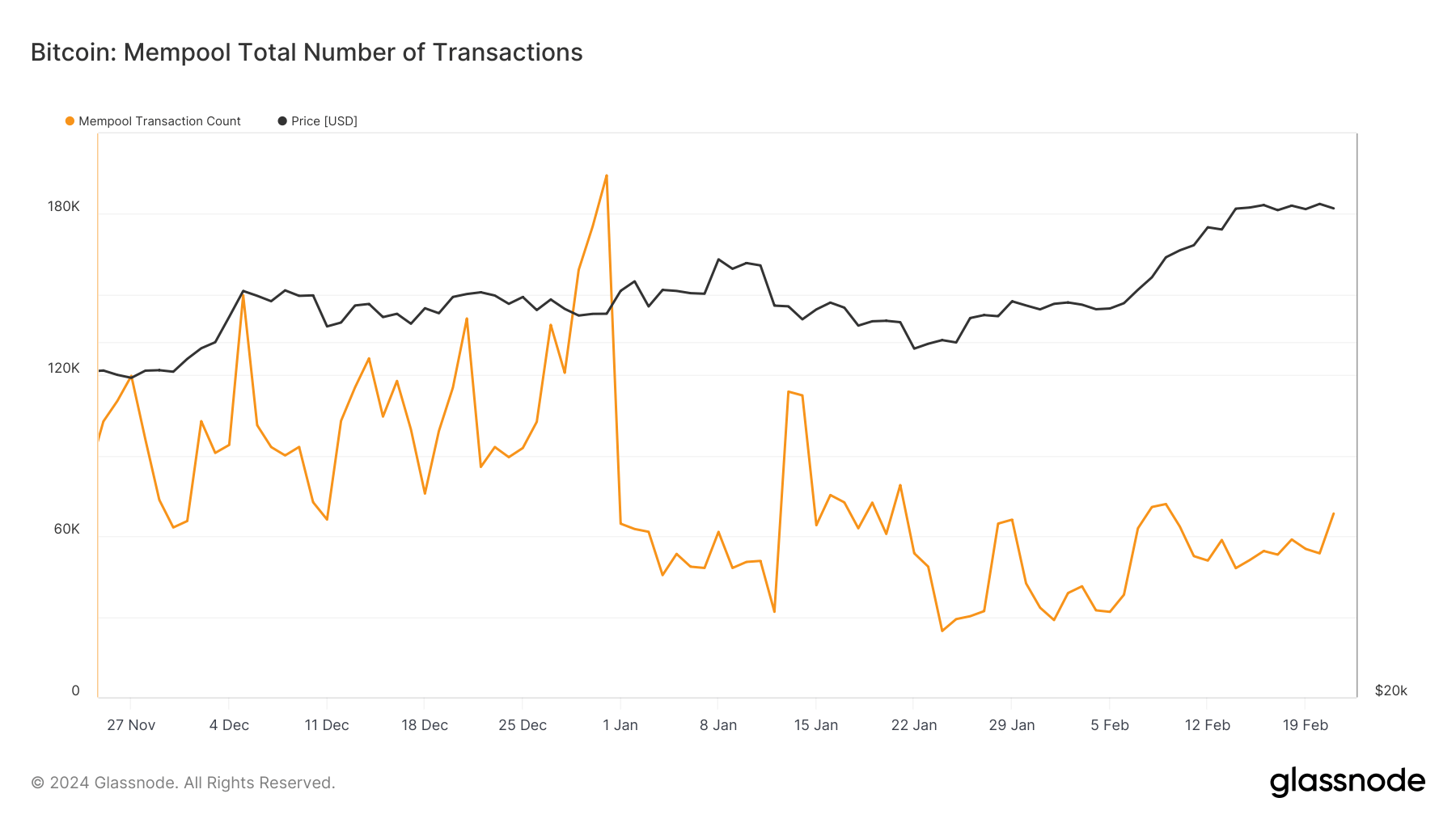

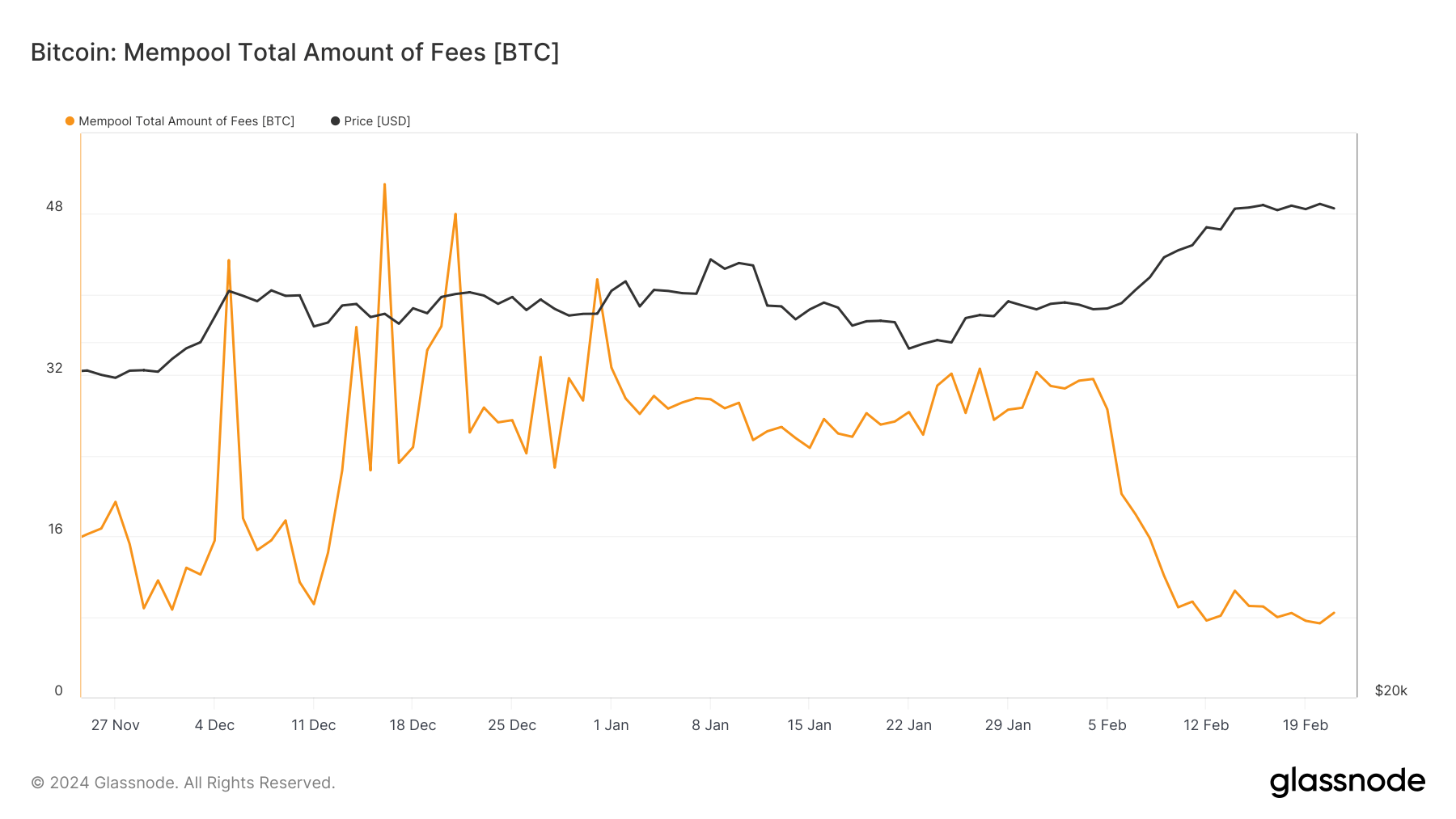

During the last months of 2023 and the first few weeks of 2024, the Bitcoin network experienced significant congestion, evidenced by swelling mempool sizes. As of mid-December, the Mempool contained 117,813 transactions waiting to be processed, with transaction fees totaling 50.9 BTC.

This congestion signaled high demand for block space and highlighted the network’s challenges in accommodating surging transaction volumes. By the end of December, the situation had worsened, with the mempool size expanding to 194,374 transactions, marking a record high in network activity and user engagement.

This congestion had little effect on the price of Bitcoin, which traded around $42,000 during the month of December. High transaction numbers and fees continued through early January, with Mempool containing 64,664 transactions and 32.7 BTC in fees on the first day of the year, further increasing the burden on the network from unprocessed transactions.

The total transaction size awaiting confirmation in the mempool further increased to 106.369 million bytes, peaking at 139.457 million bytes at the end of January. This reflects the transaction backlog and the increasing complexity or size of transactions.

The turning point in the long-term stagnation came in February. By February 21st, the Mempool had been significantly cleaned up, with total transaction fees dropping to 8.3 BTC and the number of pending transactions dropping to 68,433. The total transaction size of the mempool was also reduced to 90.439 million bytes, greatly reducing network congestion.

This period of reduced congestion followed Bitcoin’s bullish rally, rising above $52,000 before settling down around the $51,800 level.

Despite the rise in Bitcoin prices, the resolution of Mempool congestion in February is likely due to miners prioritizing transactions with higher fees, processing transactions in batches, or utilizing off-chain solutions.

Second, reduced congestion and fees have likely contributed to positive changes in investor sentiment, with improved network performance viewed as a positive indicator of Bitcoin’s utility and scalability.