U.S.-based spot Bitcoin ETFs had close to $37 billion in assets under management (AUM) within the first 25 days of trading, according to market data.

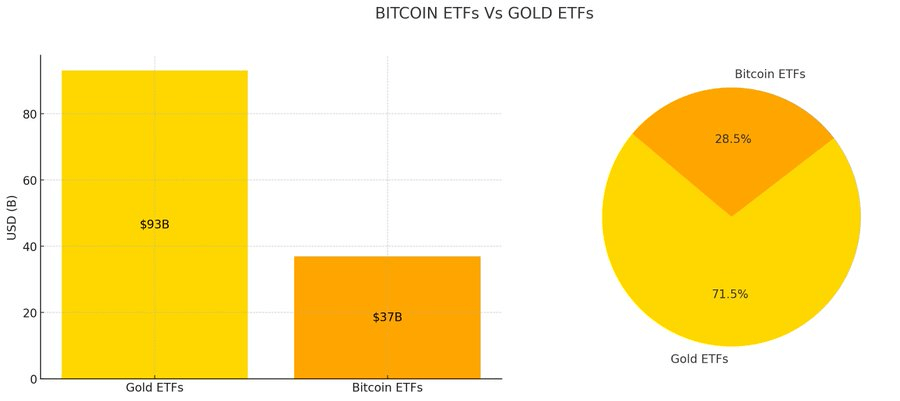

Additionally, the total AUM of Bitcoin ETFs accounts for a significant portion of the total AUM of gold ETFs, according to data shared by Bitcoin Archive.

Spot Bitcoin ETF AUM of $37 billion is equivalent to 39.8% of gold ETF AUM of $93 billion and 28.5% of the $130 billion AUM of the two classes combined.

Bitcoin ETFs Could Outperform Gold ETFs

Bloomberg ETF analyst Eric Balchunas I left a comment. Here’s what he had to say about the ETF’s 25-day growth:

“Net net flows + rally to the tune of $4 billion = gold is on pace to go through much faster than I expected.”

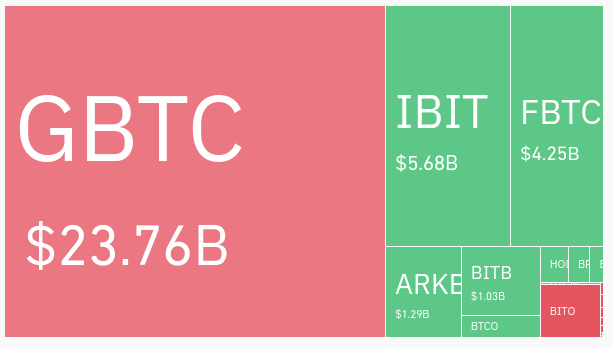

However, he said the Grayscale Bitcoin Trust (GBTC) contained significant assets before it was converted to an ETF, meaning the numbers are “not as impressive” as they may seem.

In fact, the majority of spot Bitcoin ETF AUM is accounted for by GBTC, followed by BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Wise Bitcoin Trust (FBTC).

Balchunas said that if the price of the flagship cryptocurrency rises to record highs, these ETFs could very quickly overtake gold-based products. However, he acknowledged that this outcome depends on the price of Bitcoin, which is a “huge variable,” and that a downward price trend means “it’s going to take a lot longer.”

Spot Bitcoin ETFs are currently outperforming gold ETFs on other metrics.

Gold ETF outflows have hit $3 billion to date, while spot Bitcoin ETFs have seen $4.1 billion in outflows since launch, according to CryptoSlate analysis.

It is unclear whether this trend will have a lasting impact on AUM.

The post Spot Bitcoin ETF has AUM of $37 billion, roughly one-third of gold ETF assets appeared first on CryptoSlate