Grand Cayman, Cayman Islands, February 15, 2024, Chainwire

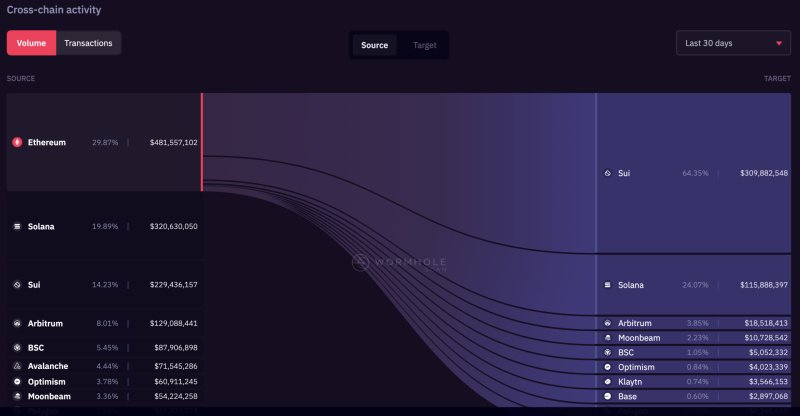

According to Wormhole Data, there were nearly $310 million in assets bridged from Ethereum to Sui last month. This is more than all other blockchains combined.

Sui, a layer 1 blockchain that has experienced explosive growth since its launch nine months ago, has seen significant movement of funds from Ethereum into the Sui ecosystem, with nearly $310 million worth of assets flowing through the Wormhole Portal in the past 30 days. I am witnessing it. The data is published by wormholescan.io, which tracks the flow of funds through Wormhole, one of the most important cross-chain bridges for wrapped tokens and NFTs and the most used on Uniswap, a prominent decentralized exchange.

As the Sui ecosystem has gained incredible traction in the past month, with total value locked exceeding $600 million and entering the top 10 of DeFi ecosystems, Wormhole’s data shows that the majority of these funds originate from Ethereum. It happened. Over the past 30 days, more than 64% of the nearly $500 million worth of funds bridged from Ethereum through Wormhole have moved to Sui. This is more than all funds sent to Solana, Arbitrum, Polygon, and all other chains combined. .

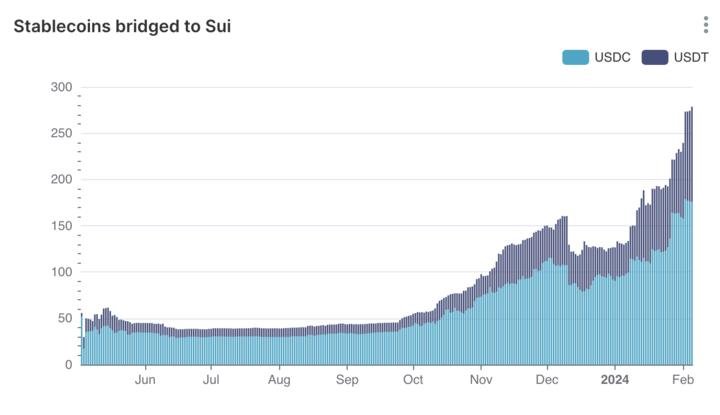

According to Wormhole data, the majority of these bridged assets are stablecoins, with USDC and USDT bridged to Sui accounting for $134 million and $78 million respectively.

![Sui turns out to be the top destination for DeFi inflows in the past 30 days 1 Sui turns out to be the top destination for DeFi inflows in the past 30 days 1]()

![Sui turns out to be the top destination for DeFi inflows in the past 30 days 1 Sui turns out to be the top destination for DeFi inflows in the past 30 days 1]() Source: wormholescan.io

Source: wormholescan.io

“The growing number of users migrating their assets to Sui demonstrates our growing belief in the strength of the community of creators, developers and enthusiasts that strengthen Sui’s underlying technology and ecosystem,” said Greg Siourounis, Executive Director of the Sui Foundation. said. “We look forward to the Sui community continuing to push the boundaries of DeFi and deliver industry-leading experiences for both users and builders.”

Source: Sui internal data

Regarding the emergence of Sui in DeFi, notable Sui internal data reflects the accelerated growth of bridge stablecoins USDC and USDT to the Sui ecosystem starting in the fourth quarter of 2023. TVL for USDC and USDT surged from below $50 million. In less than five months, it has risen more than 400% to well over $250 million.

In addition to empirical data, recent months have also seen qualitative trends showing that Sui is becoming a major hub of DeFi excitement and activity. This is the best project I chose to build on top of Sui. In December 2023, two major projects originating from other protocols chose Sui for expansion or full migration.

Solend, which remains Solana’s top lending protocol with nearly $180 million in TVL, has committed its entire team to launch Sui’s new lending protocol, called Suilend. Similarly, Bluefin, a decentralized derivatives exchange that has already achieved over $1 billion in trading volume on Arbitrum’s v1 application, is suspending its initial implementation to focus entirely on the latest version built on Sui, achieving $2.3 billion in trading volume in the first four months. has been achieved. On the network. Both projects mentioned Sui’s performance capabilities when describing their moves.

Recently, Sui announced two important steps that will transform Sui into the DeFi platform of choice for builders, developers, and users. First, Sui announced the launch of an interest-bearing stablecoin alternative on Sui with Ondo Finance, the third largest platform providing tokenized real-world assets to public blockchains. Equally important, our new partnership with Banxa, a leading payment infrastructure provider for cryptocurrency-compatible economies, enables entry and exit through the Banxa platform. Combining these steps will broaden the appeal of the Sui platform to include a much wider audience.

contact

Sui Foundation

media@sui.io