Market reaction to CPI data

The global cryptocurrency market and Bitcoin suffered a decline following the release of better-than-expected US Consumer Price Index (CPI) data.

Impact of fixed interest rates

The Federal Open Market Committee’s (FOMC) decision to keep interest rates unchanged despite high inflation rates has brought bearish sentiment to the cryptocurrency market.

Global cryptocurrency market, including: bitcoin (BTC) fell slightly in reaction to the latest US Consumer Price Index (CPI) report. The CPI annual rate exceeded expectations, rising from 3.4% to 3.1% compared to the expected rate of 2.9%. Nonetheless, the Federal Open Market Committee (FOMC) decided to keep interest rates in the current range of 5.25% to 5.50%.

This decision, combined with expectations of a similar stance at the upcoming FOMC meeting on March 20, has contributed to the bearish outlook for the cryptocurrency market.

According to data from CoinGecko, the global cryptocurrency market capitalization has decreased by 0.3% in the last 24 hours and now totals $1.95 trillion. Similarly, Bitcoin was trading at $49,600 at the time of reporting, down 0.8%. BTC’s daily trading volume also decreased by 13% to approximately $34 billion. In particular, Bitcoin reached an intraday low of $48,470 immediately after the release of the CPI report.

Also Read: Bitcoin Halving in 2024: What to Expect and How It Will Affect Your Cryptocurrency Portfolio

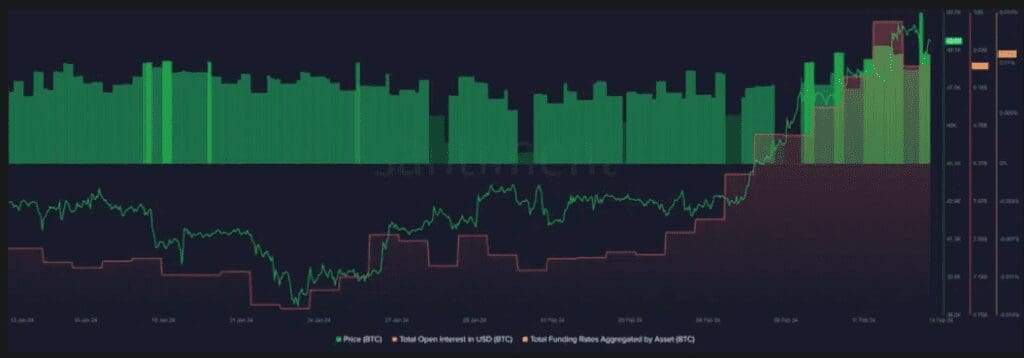

Data from Santiment shows Bitcoin’s total open interest (OI) decreased from $9.9 billion to $9.4 billion, a decrease of about $500 million. Additionally, since the FOMC meeting, the total funding rate across all exchanges has decreased from 0.014% to 0.01%, indicating fewer traders anticipating further price surges and reflecting the bearish sentiment prevalent in the market.

Future market expectations

Despite the current market sentiment, Bitcoin options trading for the March 29 expiration is suggesting optimistic expectations, with traders hoping to see the price rise from $60,000 to $75,000, as reported by crypto.news on February 13. There are speculations that it will reach an all-time high in the dollar.