Solana (SOL) price surged to a 30-day high of $107 on January 30 as increased DeFi volume from layer 1 network airdrops boosted investor confidence.

Solana is trading at $98 as of press time on February 5th, down 8% from its recent high of $107 just six days ago. However, a clear comparison of Solana’s price and current volume trends in particular shows that most SOL holders are positioned in the early stages of a rebound.

Solana outperformed the market and hit a 30-day high.

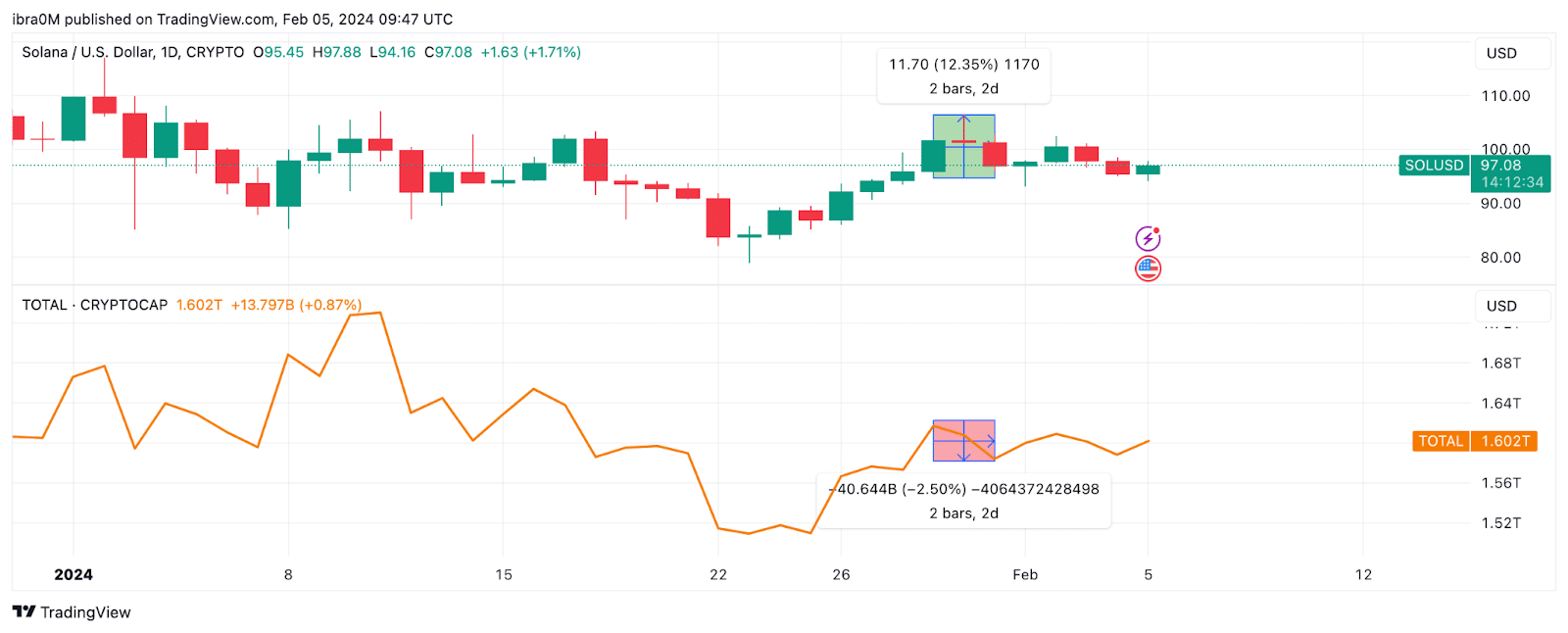

Solana’s price bucked the market trend on January 30 and soared 12.4%, hitting a 30-day high of $107, while the rest of the cryptocurrency market was affected by the U.S. Federal Reserve’s suggestion of delaying interest rate cuts beyond March 2024. ) faced negative backlash due to Chairman Jerome Powell’s comments. .

As shown in the chart below, within 24 hours of Powell’s remarks on January 31, global cryptocurrency market capitalization fell 2.5%, losing more than $40 billion.

Meanwhile, SOL price has rebounded due to increased demand across the defi ecosystem and positive speculation surrounding the upcoming Jupiter (JUP) airdrop.

However, after being rejected at $107 on January 30, the price of SOL is now down 8%, trading around $97 as of press time on February 5. But interestingly, key market data trends show that most current SOL holders still hold SOL. The outlook is optimistic due to the continued decline in Solana prices.

Solana price consolidated as holders abstained from selling.

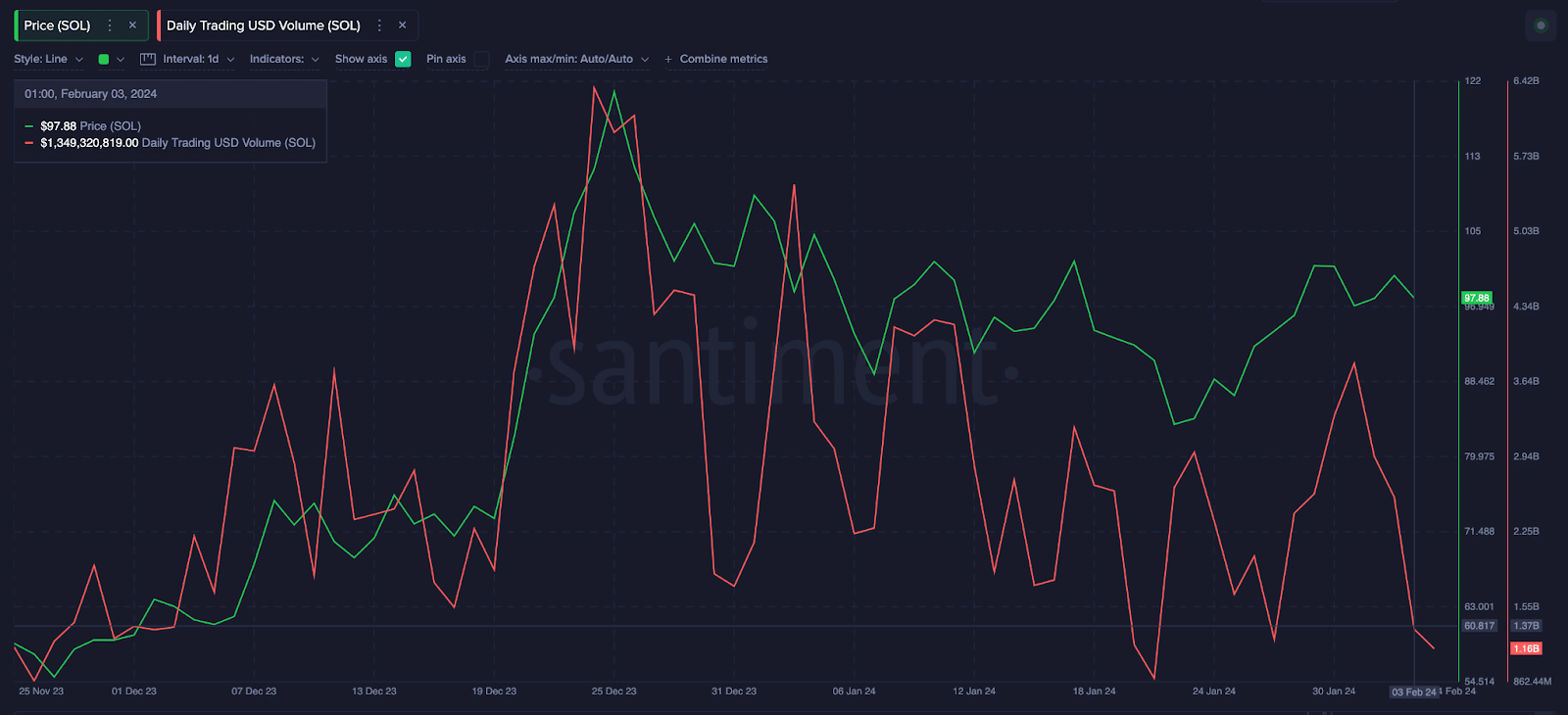

Looking at the Santiment chart below, you can see that Solana’s trading volume peaked at $3.8 billion on January 31st during last week’s rally. However, SOL holders are increasingly refraining from trading, especially as prices begin to fall.

The latest figures show Solana trading volume is down $2.4 billion from last week’s peak, with just $1.4 billion worth of transactions involving SOL on February 4.

In fact, Solana holders reduced their trading activity by 56% between January 31 and February 5, while Solana prices fell only 8% during that period.

As observed above, when volume is decreasing much faster than the downward price trend, this indicates prevailing positive confidence among current holders.

Essentially, this decrease in volume means there is resilient SOL price performance as existing holders are not in a hurry to sell or liquidate their positions.

Solana network usage has reached an all-time high.

In addition to reduced selling pressure, important fundamental factors such as increased demand due to increased DeFi activity and positive speculation surrounding the Jupiter project further strengthened support for SOL price last week.

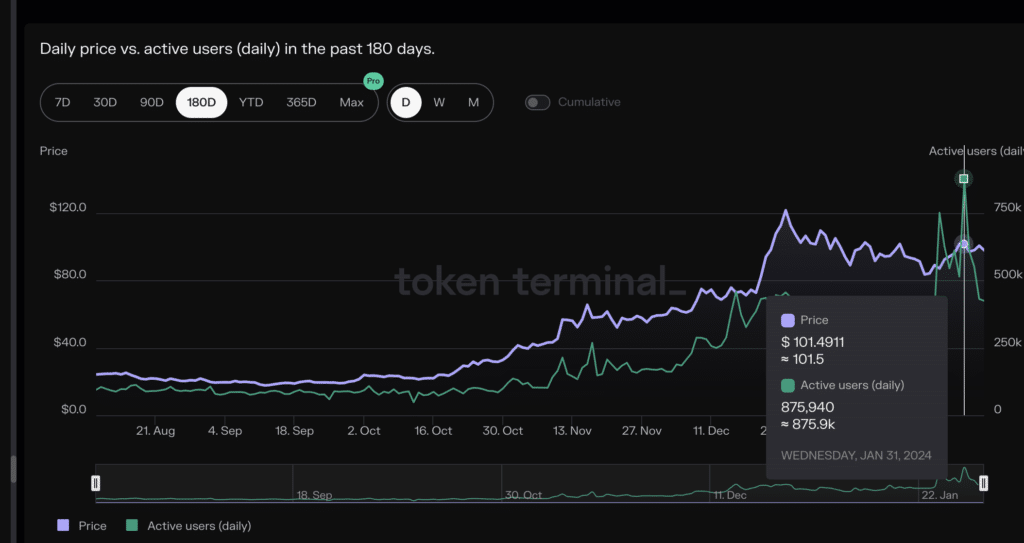

According to Token Terminal data, Solana had more than 875,000 active users as of January 31, the highest record for the layer 1 network since its launch in 2020.

Since then, Solana has maintained a five-day average of 578,000 active users, more than 26% higher than its 2023 peak of 458,210 users.

The surge on January 31st was not an unusual event, but rather a sign of organic growth and increased adoption of projects built on the Solana layer-1 network.

Solana Price Prediction: Focus on $120 Retest

Network growth and reduced selling pressure puts Solana in prime position for another leap toward the $120 region in the coming days.

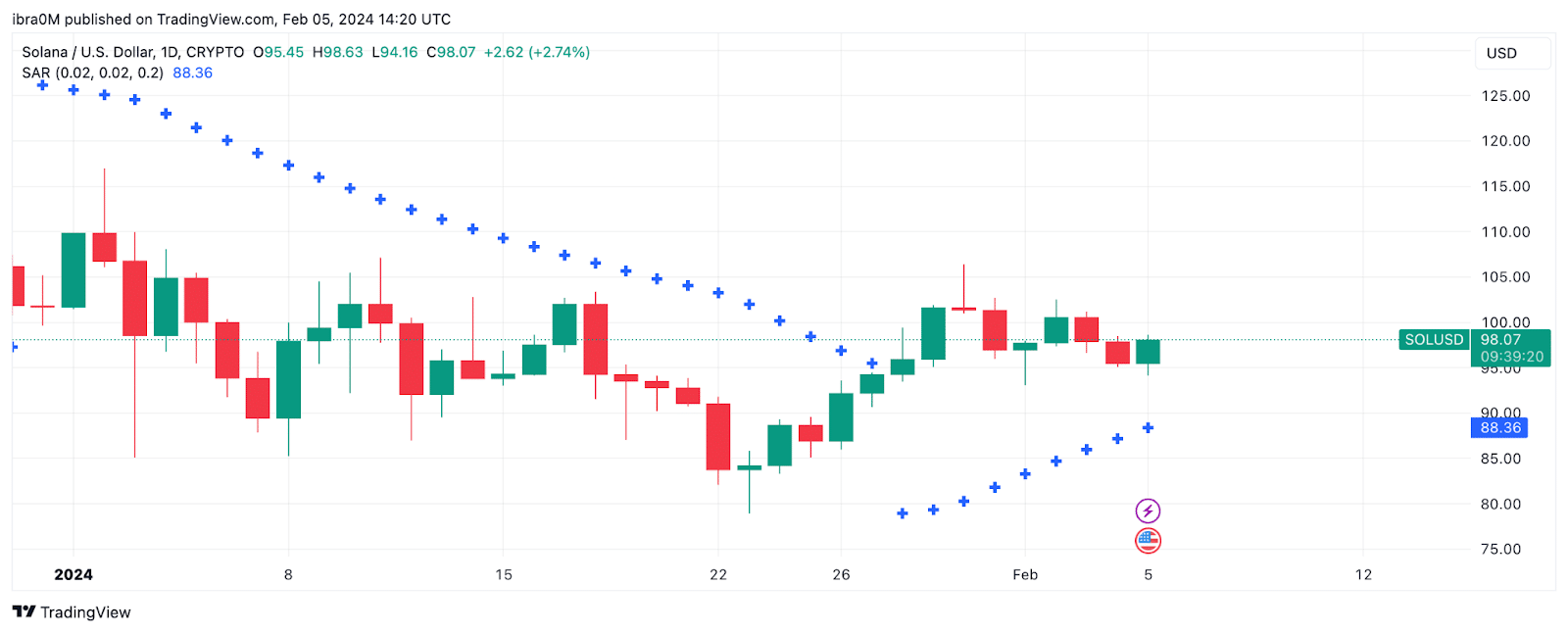

Additionally, the current trend observed in the Parabolic SAR technical indicator supports this bullish SOL price prediction.

When the parabolic SAR points below the asset’s current price, it indicates that a reversal in the ongoing downtrend is imminent. In this case, the blue dot representing Parabolic SAR currently points to $87, while the current Solana price is $0.98, confirming the positive prediction.

Traders often interpret this situation as a signal to hold or buy more. This is because it suggests that the price trend may be on the verge of a bullish reversal.

If this scenario plays out as expected, the bulls could make a decisive breakout towards the $120 area.

Conversely, a bearish trend could negate this bullish forecast by forcing a correction below $85. However, as explained in the SAR point above, the $87 support buy wall could be a challenge.